Marin County Real Estate Report - January 2021

January 18, 2021

Source: Compass

A Strange Year Begins Winding Down |

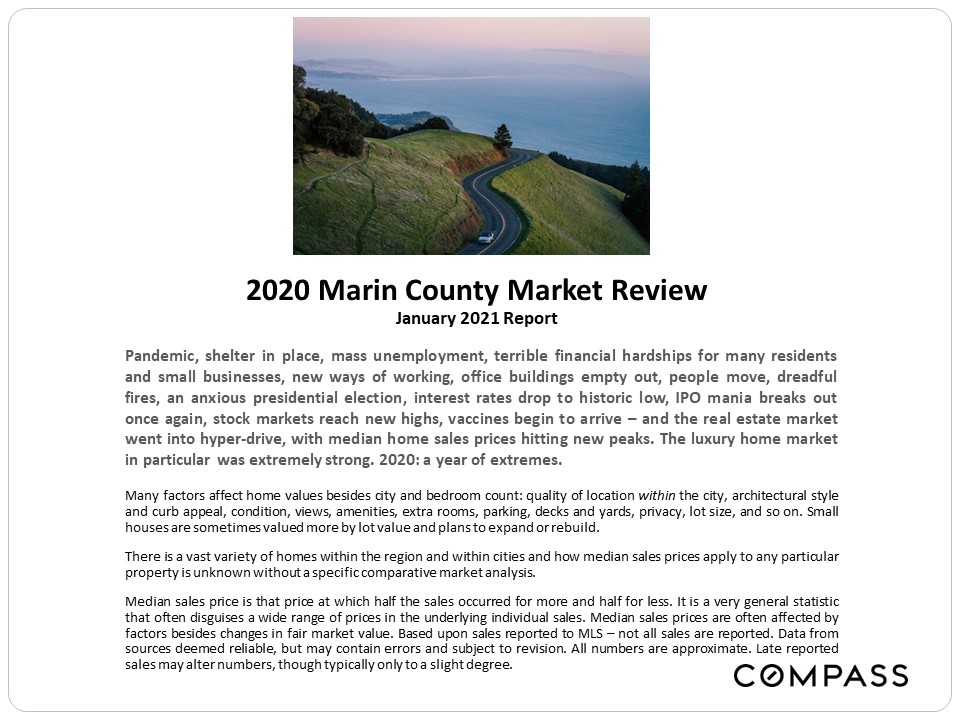

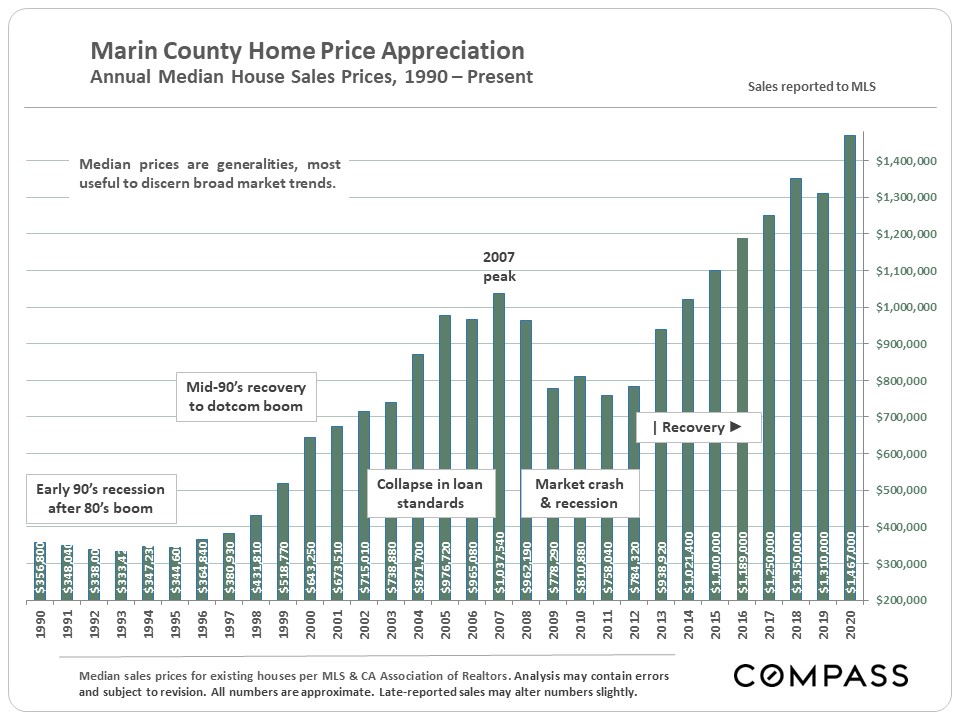

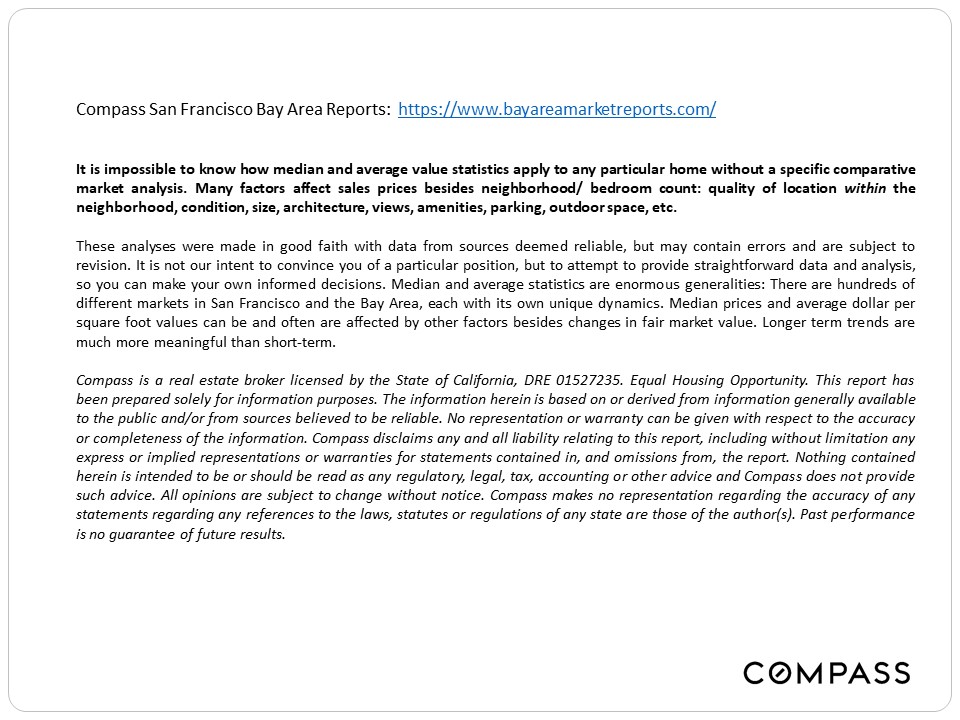

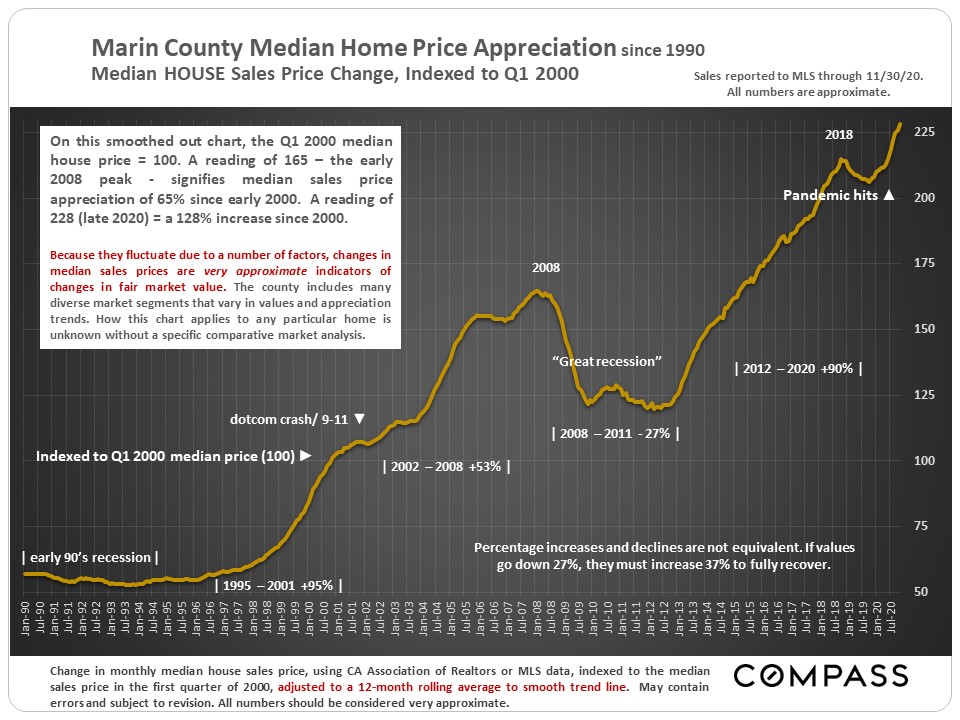

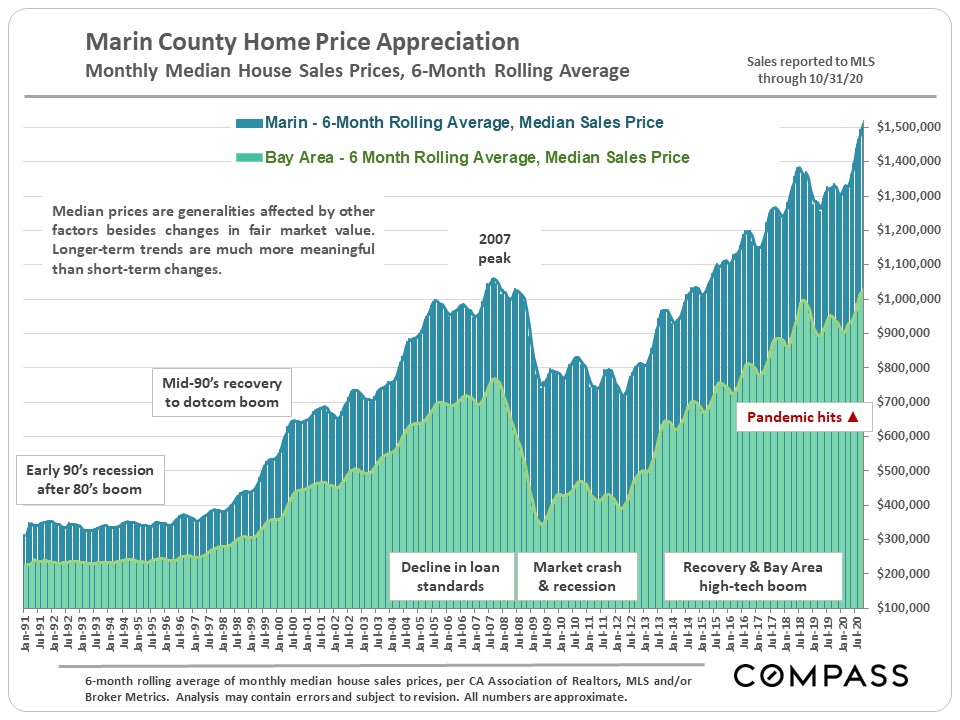

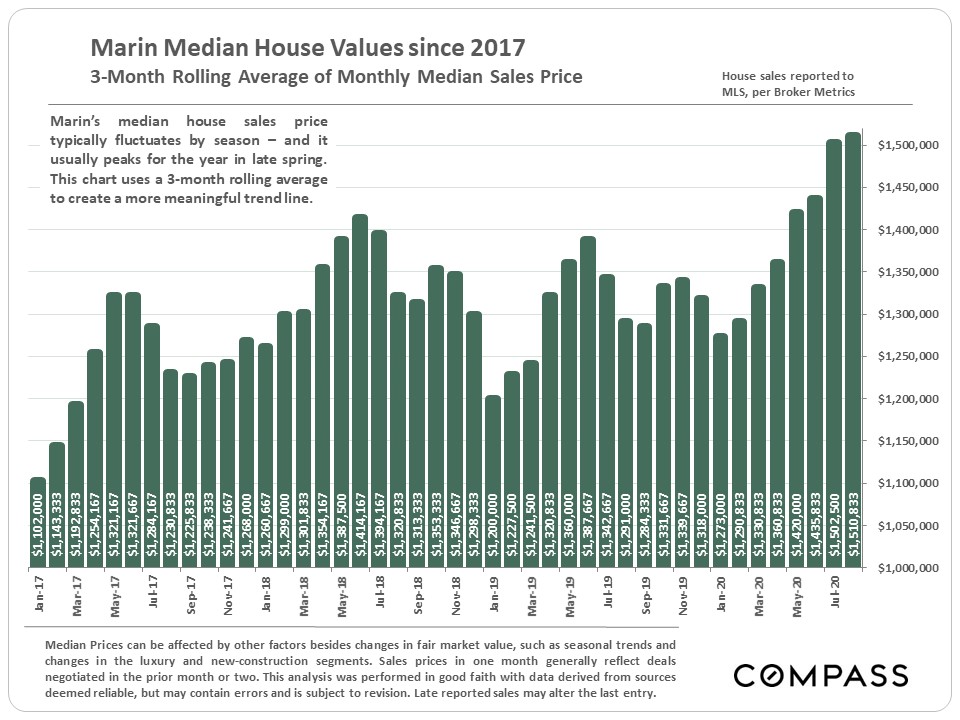

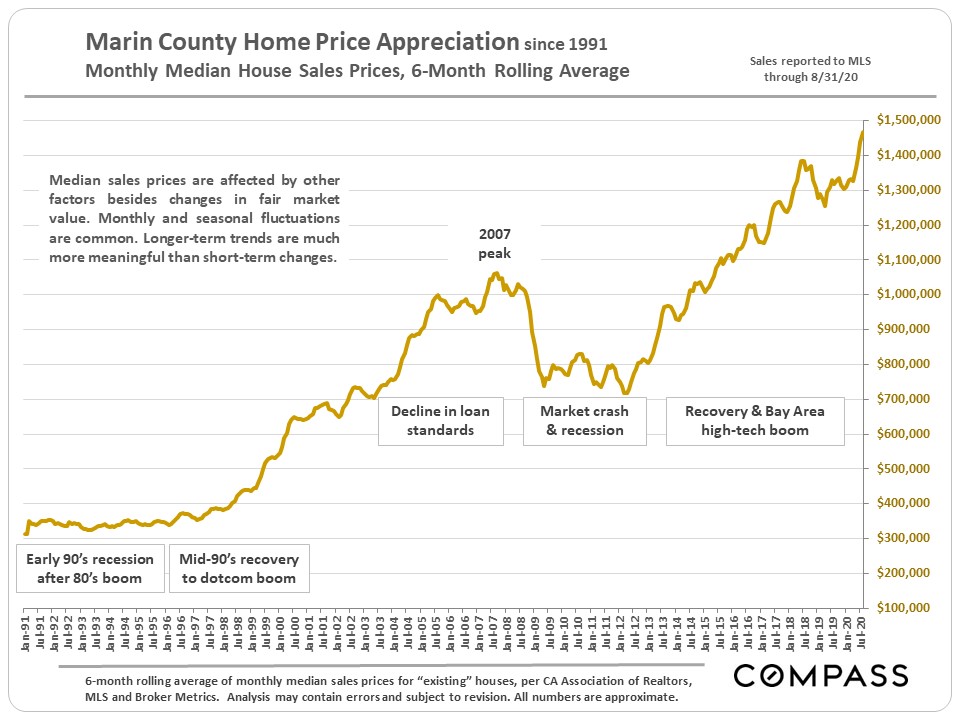

Though Covid-19 upended many normal seasonal trends this year, the market did begin its typical “holiday season” slowdown in November - however activity remained well above levels of last year. It is unknown how the latest pandemic circumstances may affect the market in December, which is usually by far the slowest month of the year. More importantly, we hope you and your loved ones stay safe and well during this challenging holiday season. This first chart below tracks percentage changes in median house sales price since 1990. It is based upon the Q1 2000 price being indexed to 100: A reading of 50 signifies a median price half that in Q1 2000; 200 means the price has doubled since then. In early 1990, the Marin median house price was about $350,000; it is currently running about $1,525,000. |

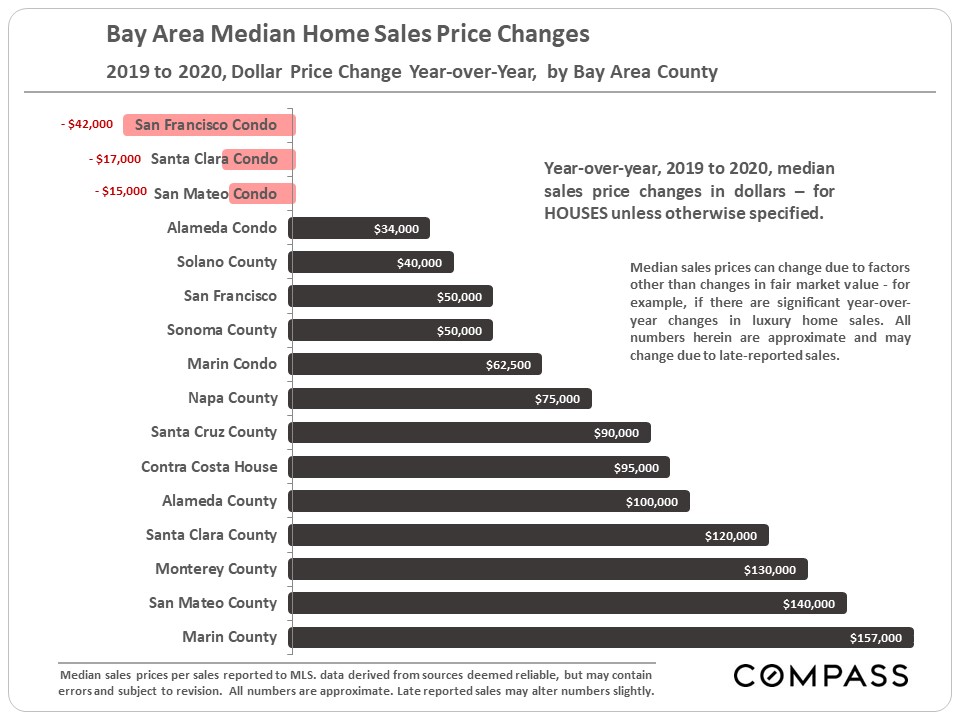

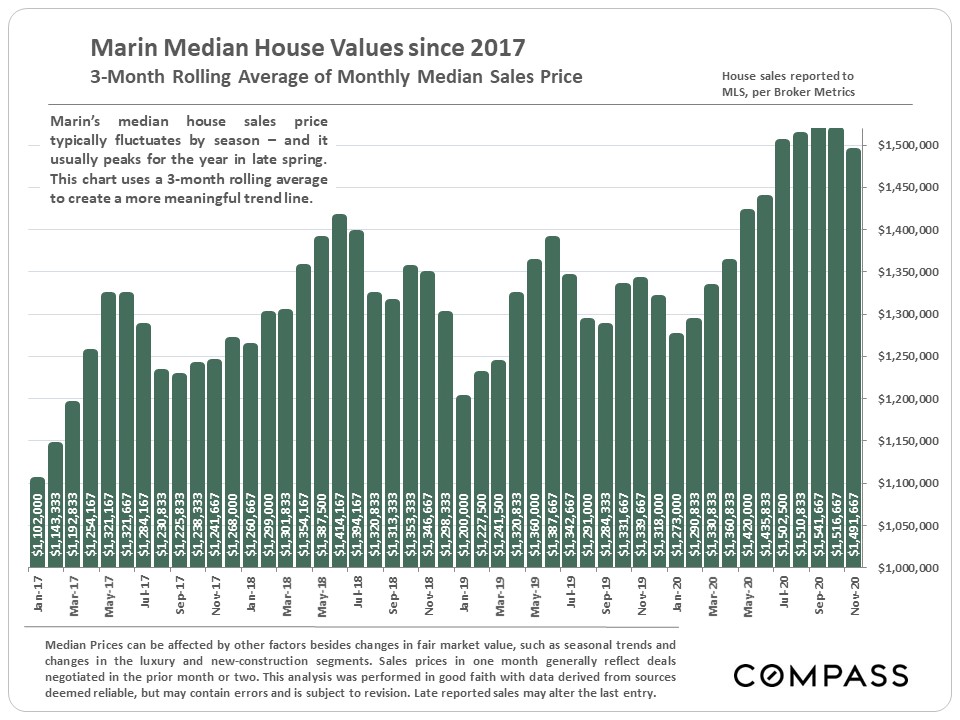

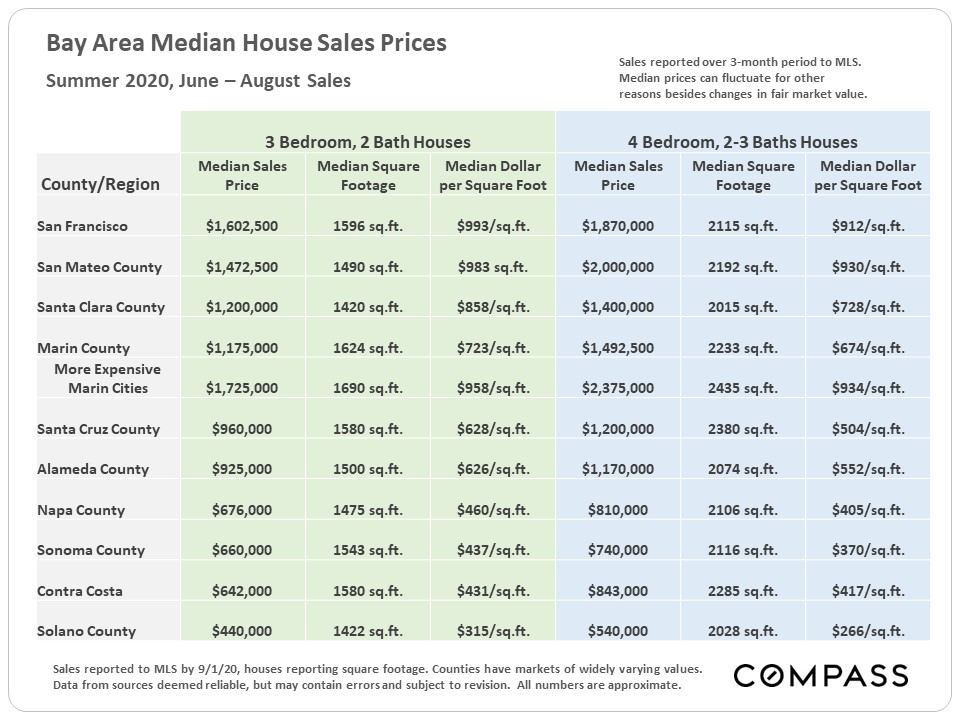

Below is a survey of Q3 2020 median home prices around the Bay Area. |

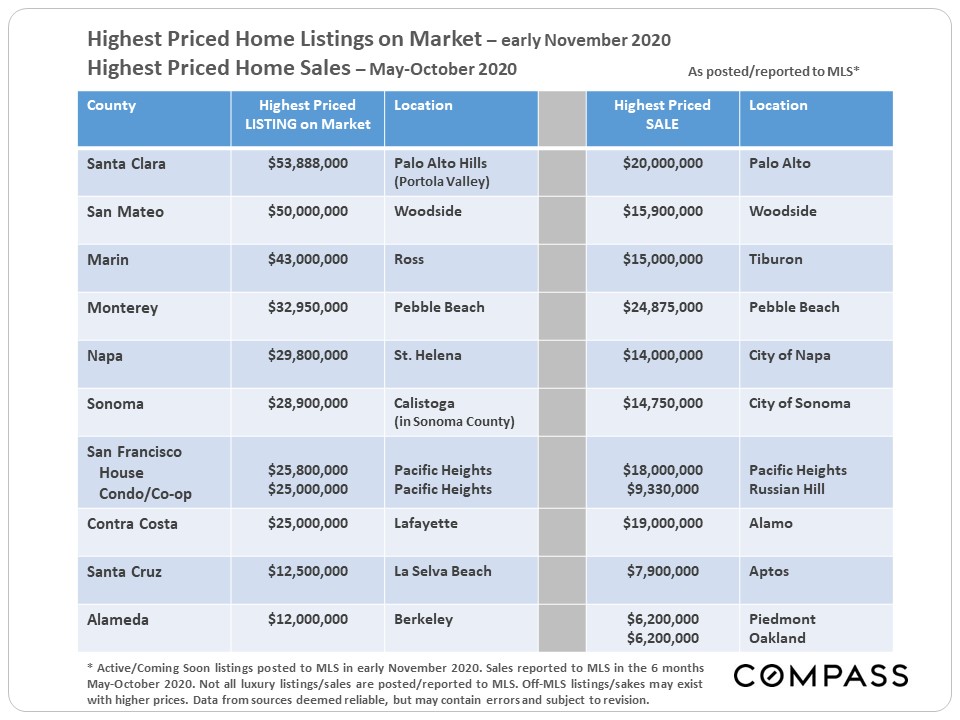

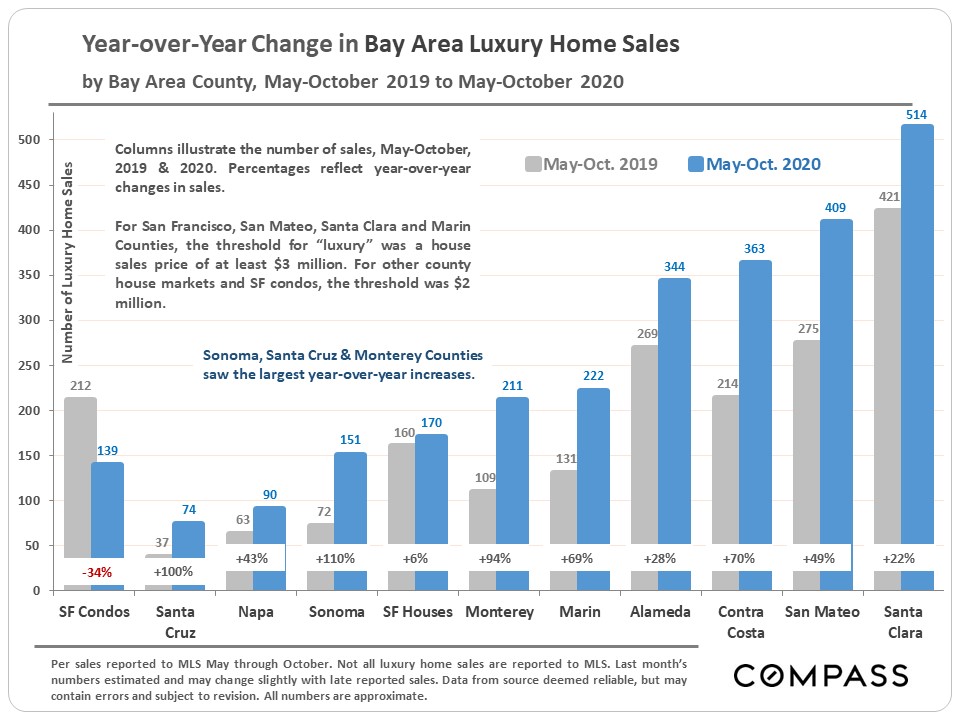

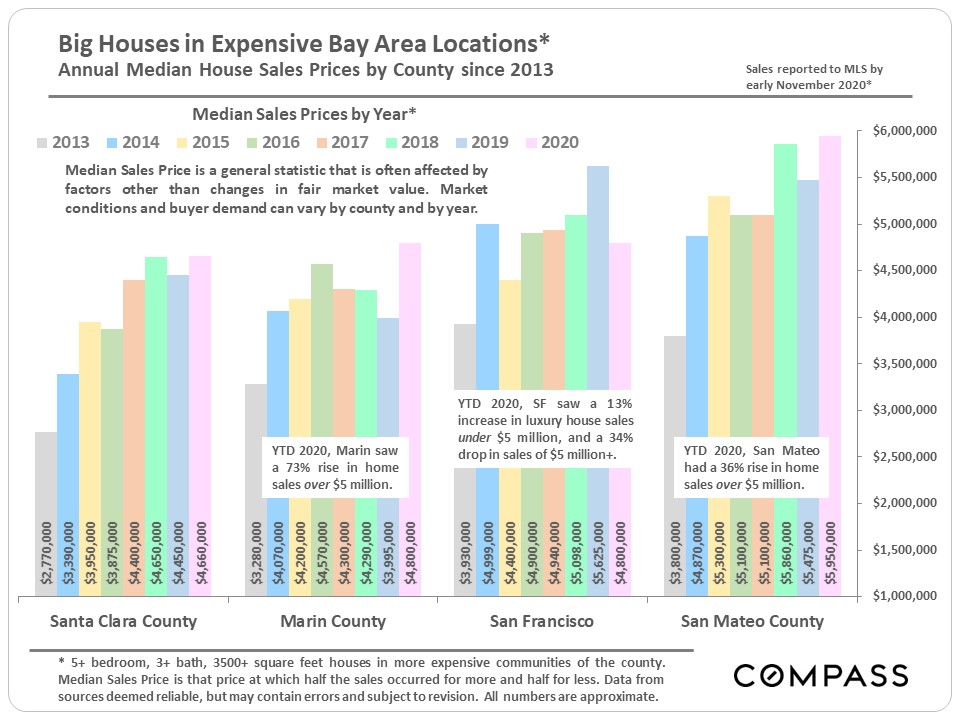

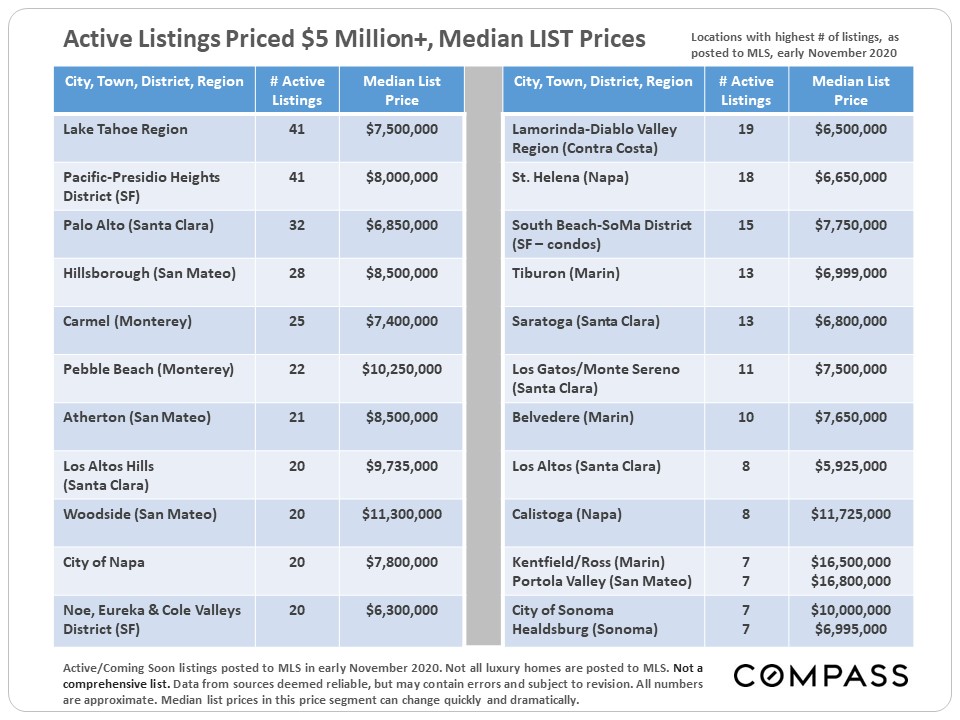

Highest priced listings on the market in early November, and the highest priced MLS home sales occurring May through October 2020, by Bay Area County. |

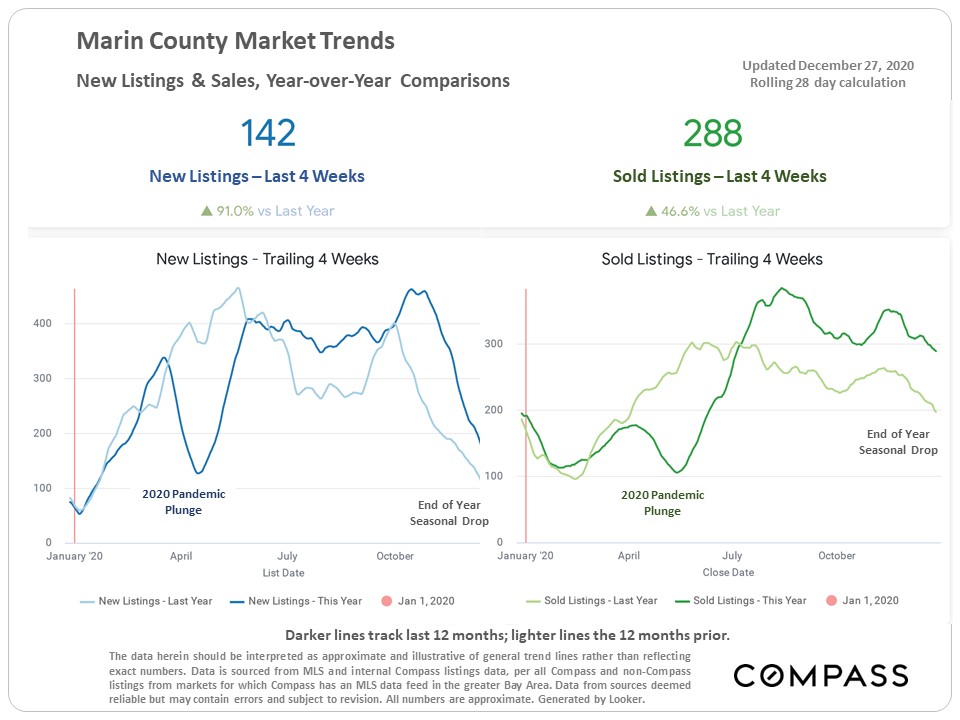

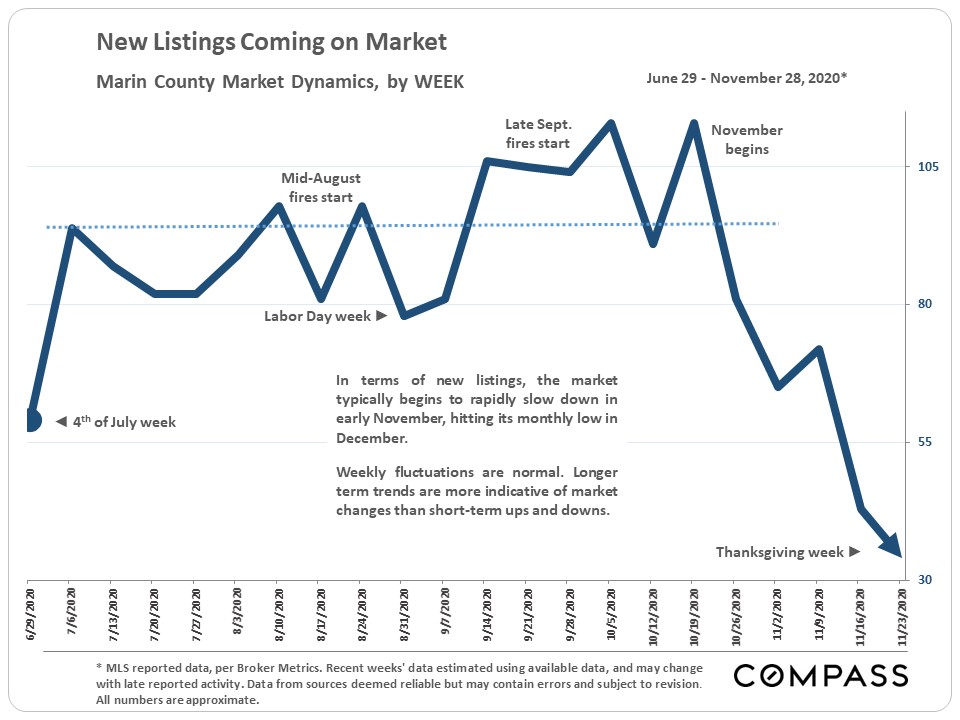

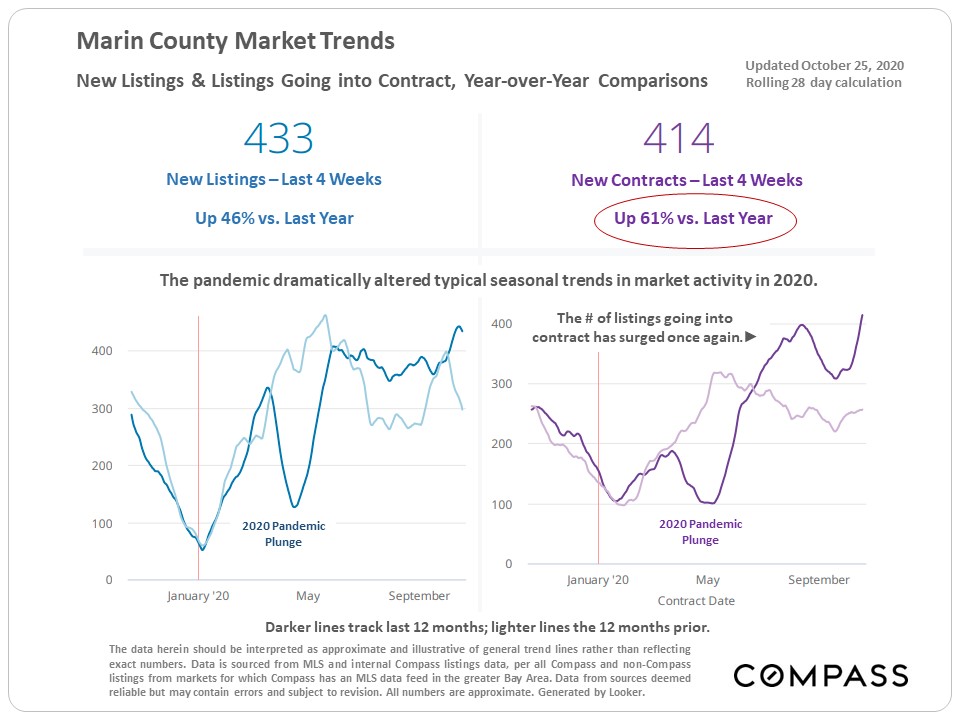

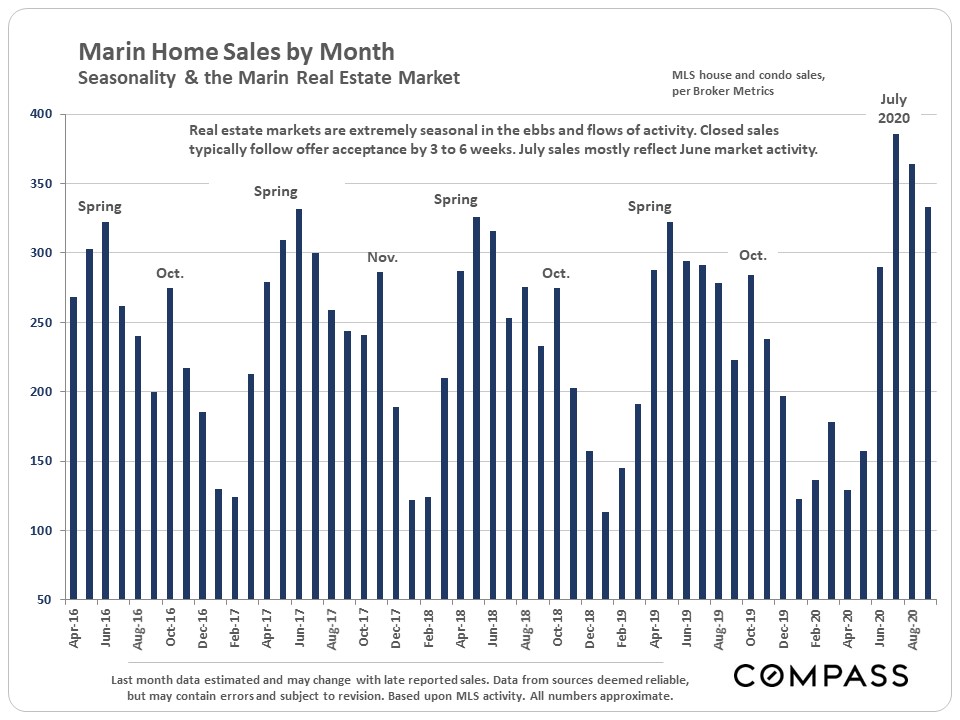

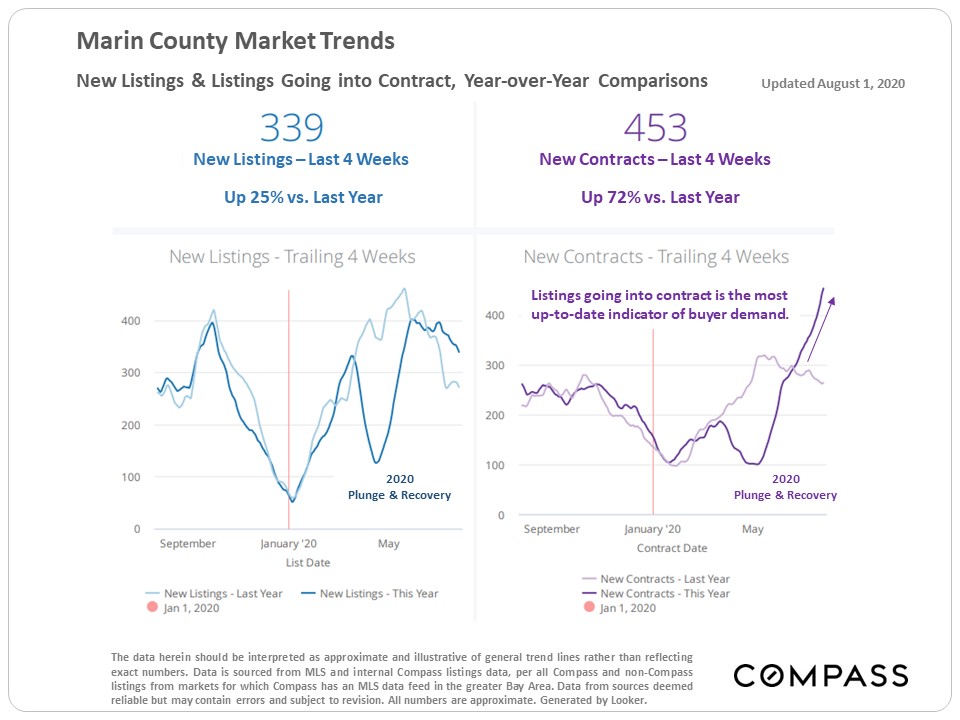

As is typical, the number of new listings plunged in November. In the first week of December - not illustrated on this chart - new listing activity ticked back up from the short Thanksgiving week, but remained well below pre-November numbers. December is usually the month with the fewest new listings coming on market. |

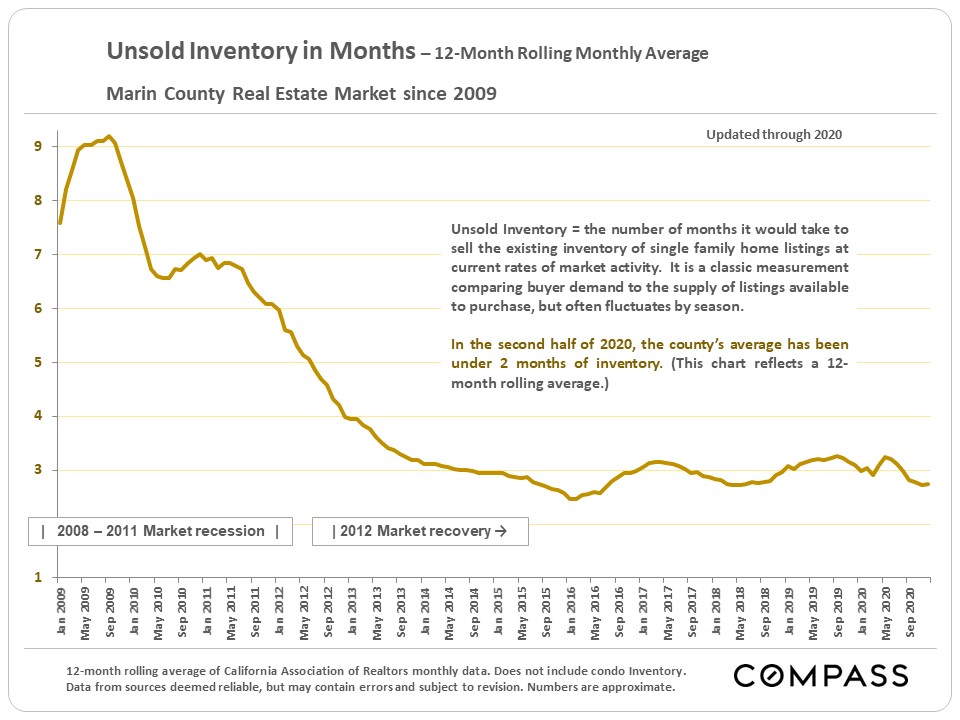

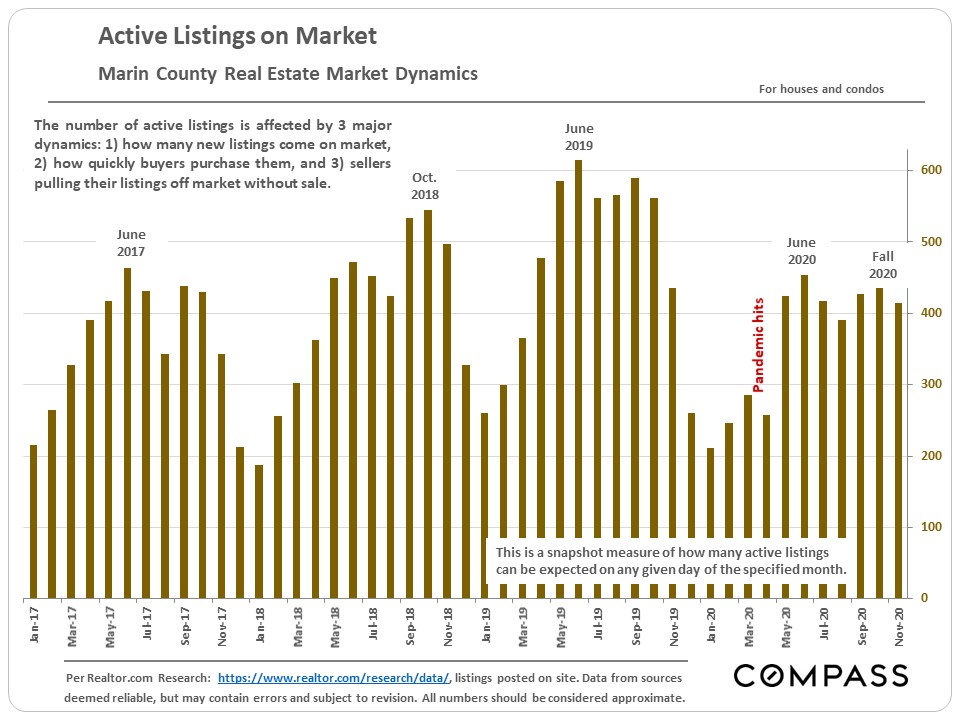

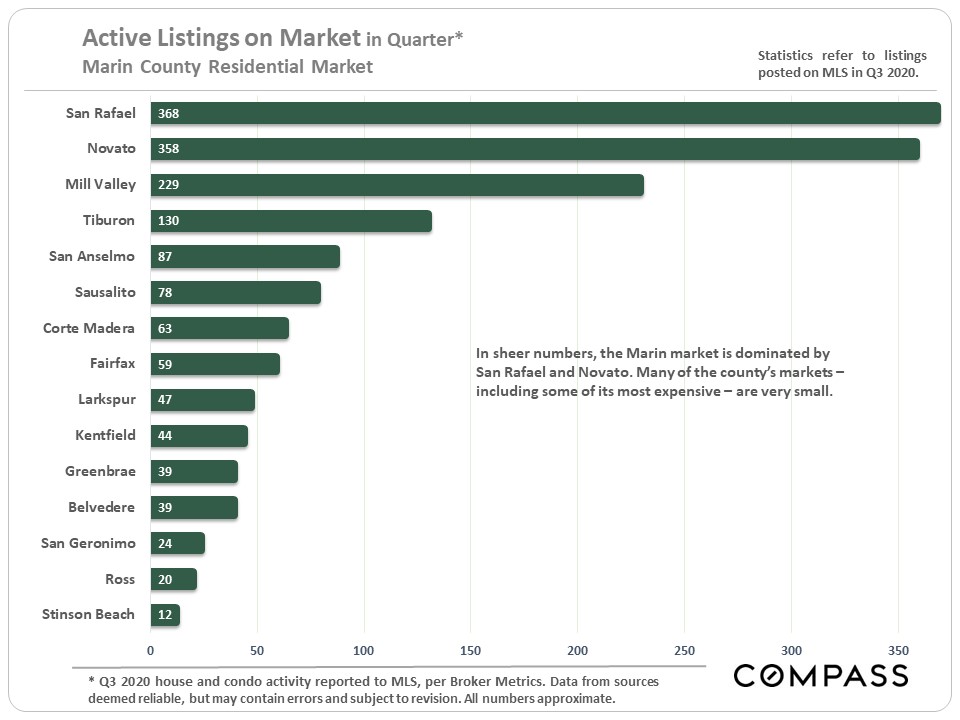

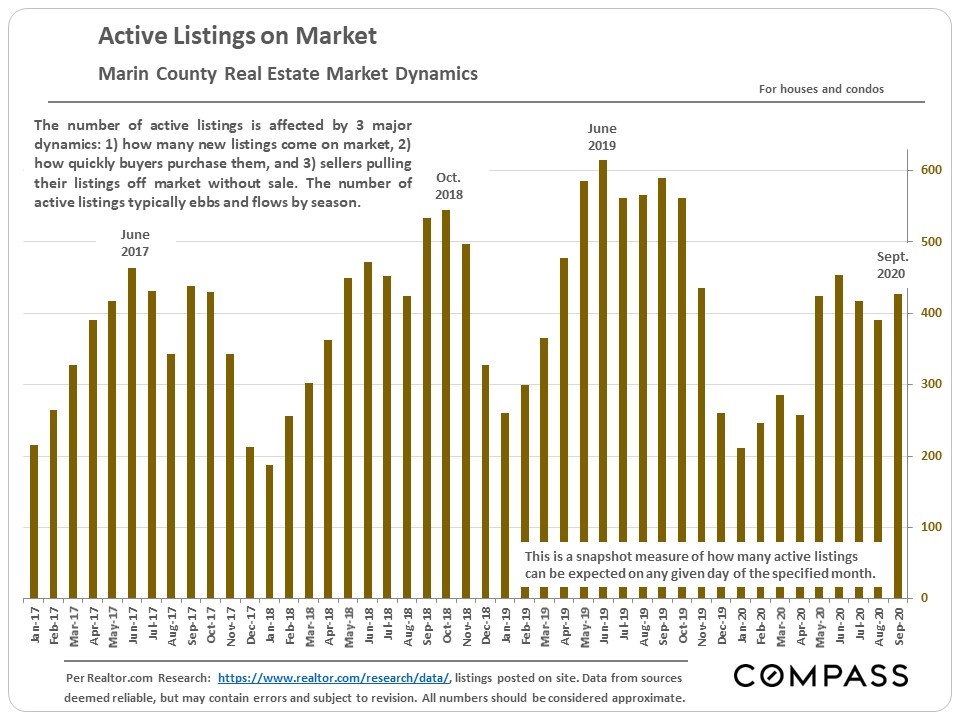

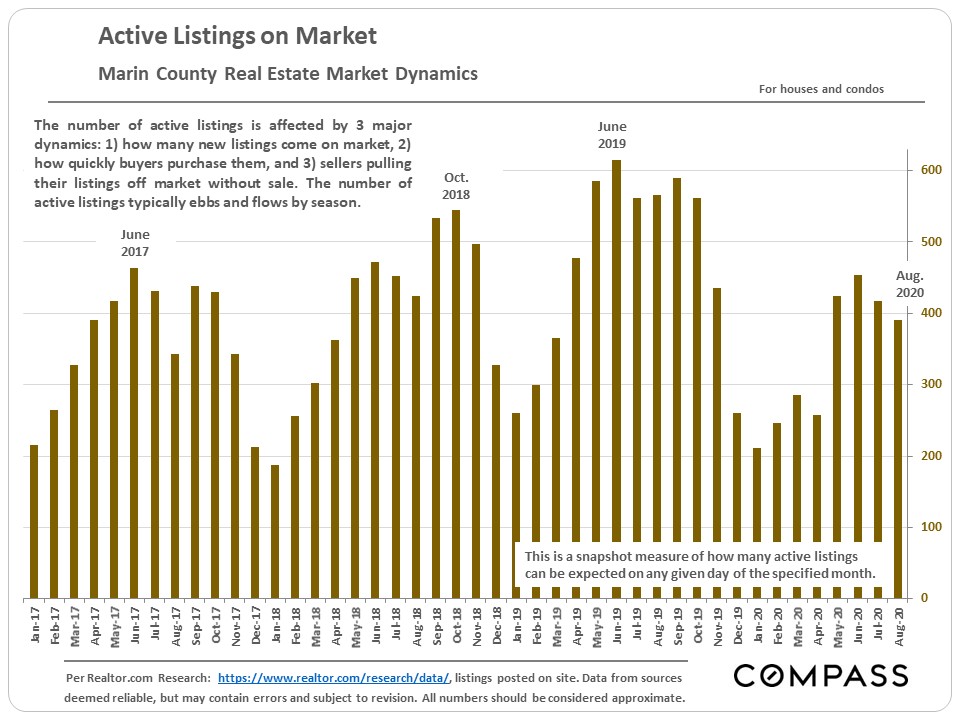

A major factor in the Marin market has been the relatively low number of active listings available for purchase. |

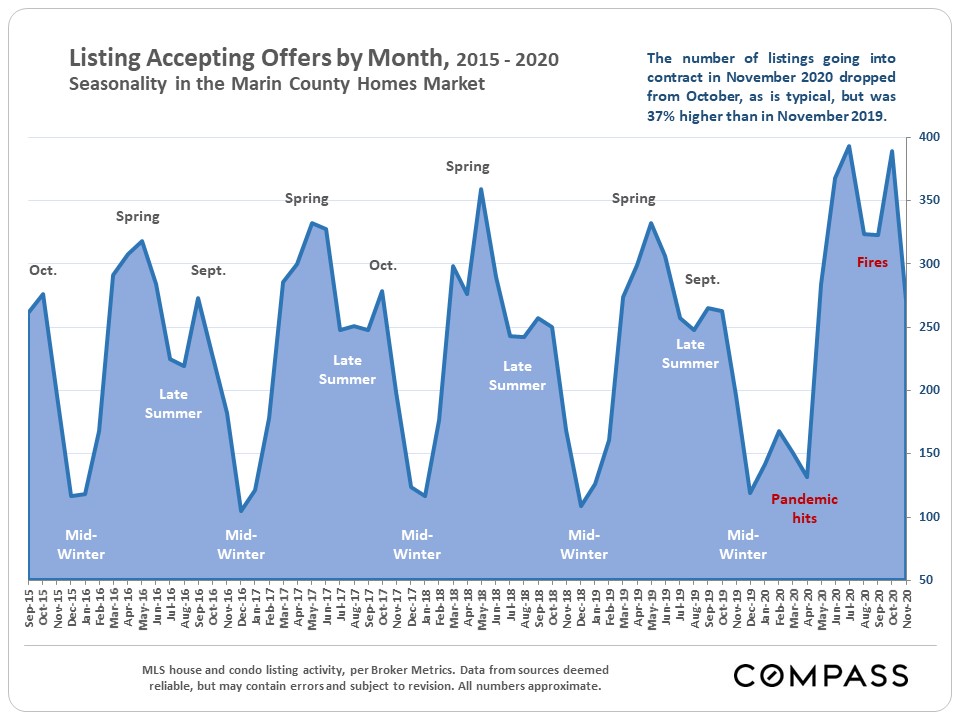

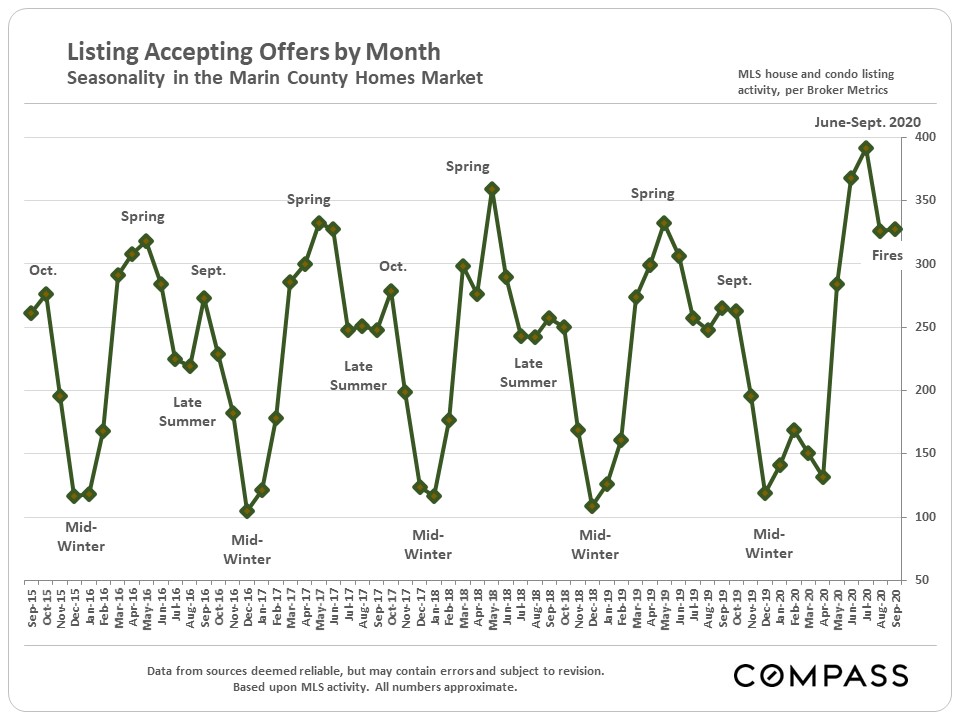

Market activity as measured by the number of listings going into contract, though dropping in November - as is the normal seasonal trend - was significantly higher on a year-over-year basis: 37% higher than in November 2019. |

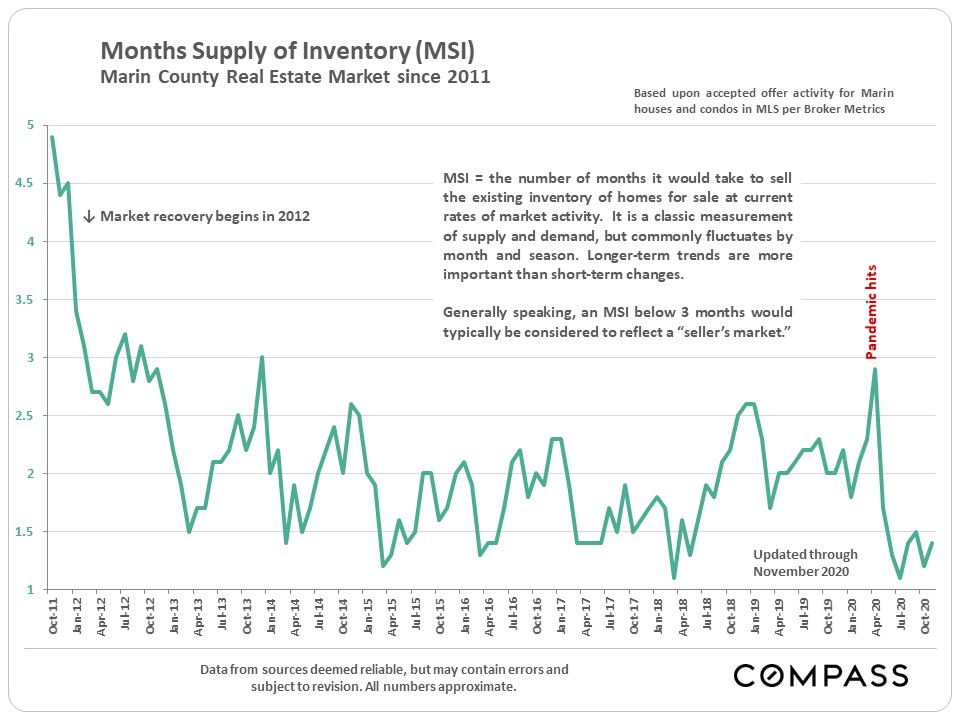

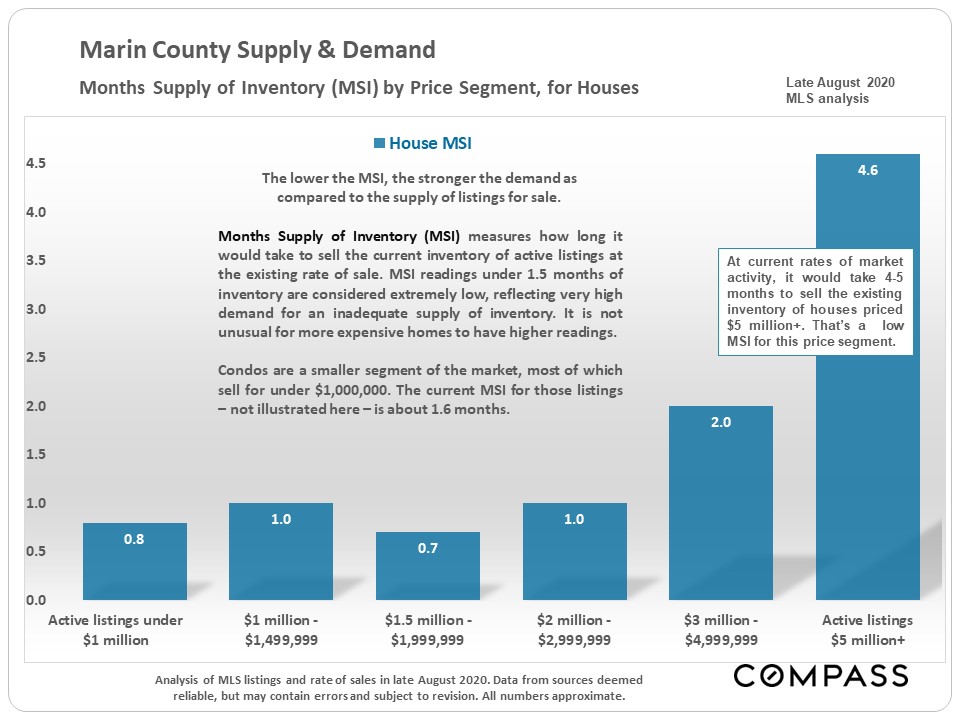

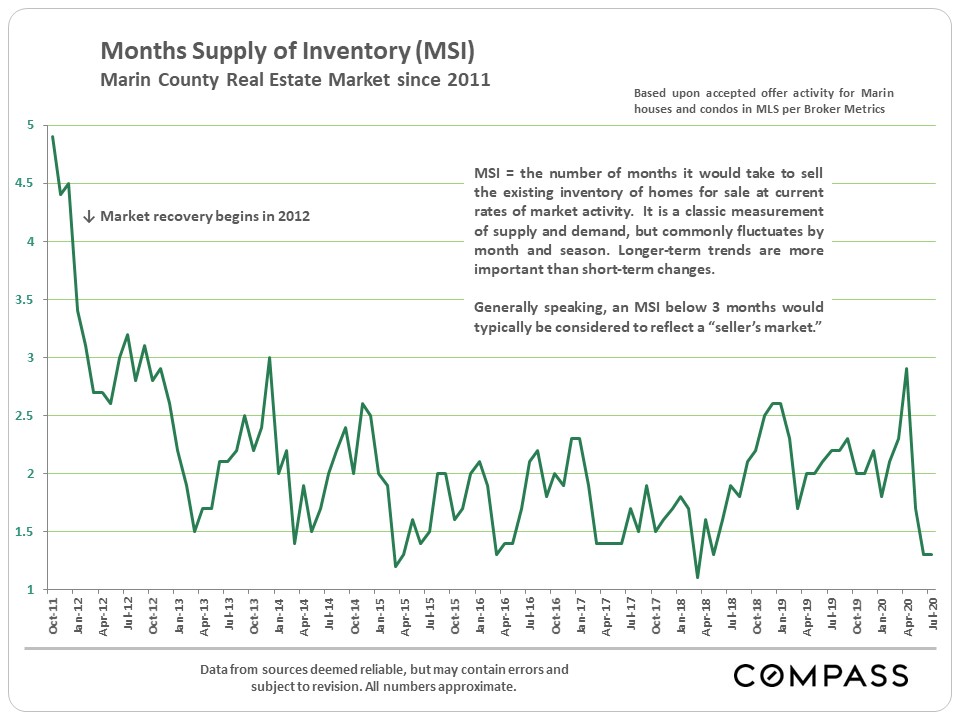

A standard measure of supply and demand, months-supply-of-inventory has been bumping along at extremely low levels in recent months. |

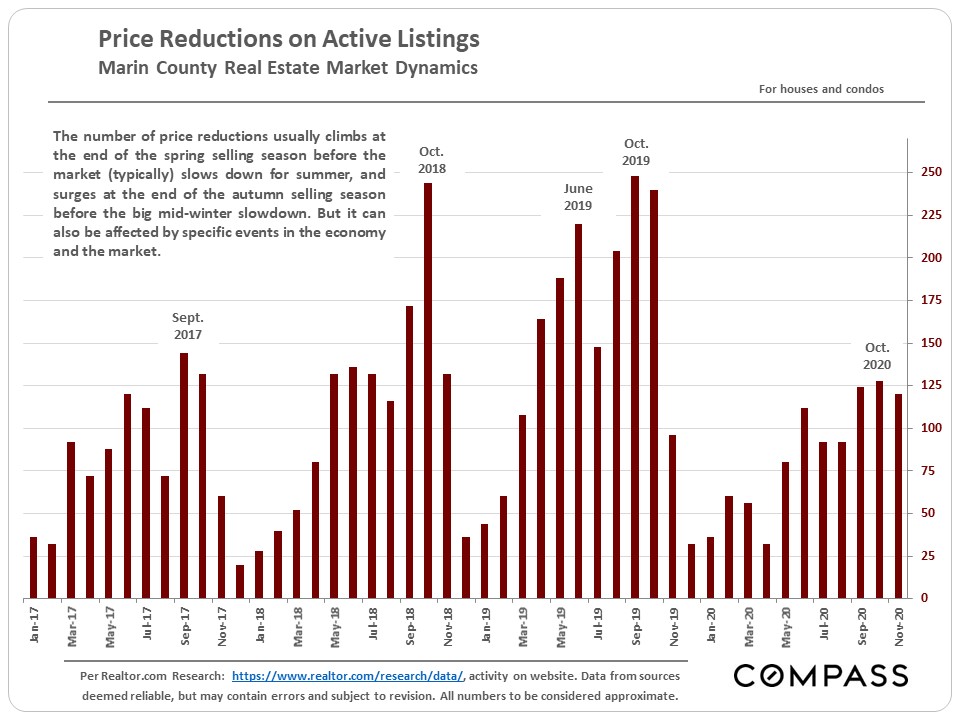

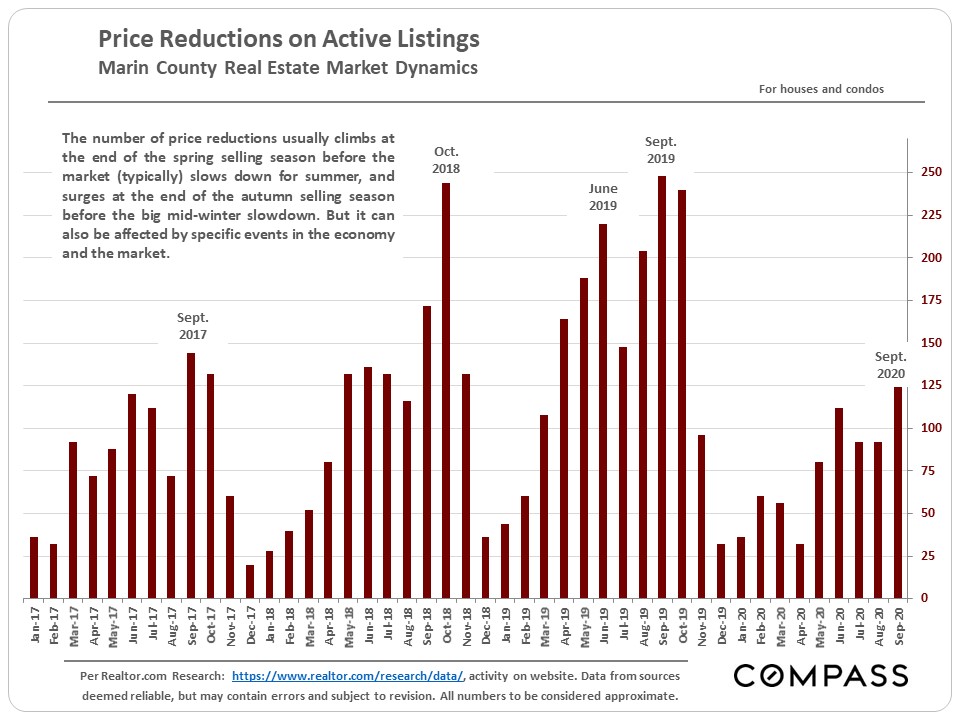

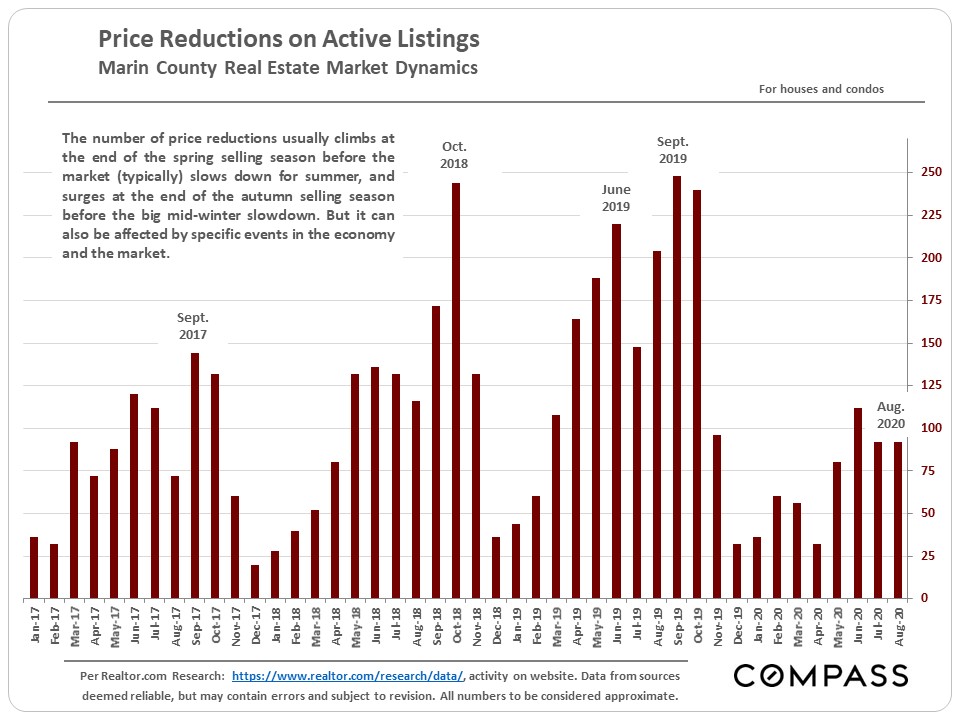

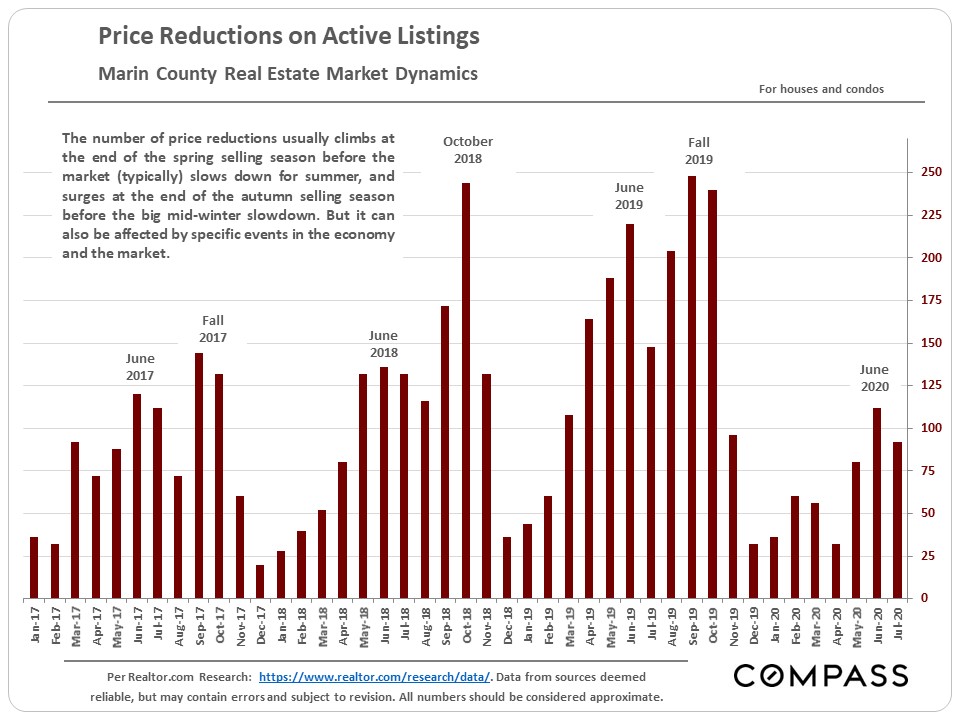

A stronger, higher demand market = fewer price reductions. |

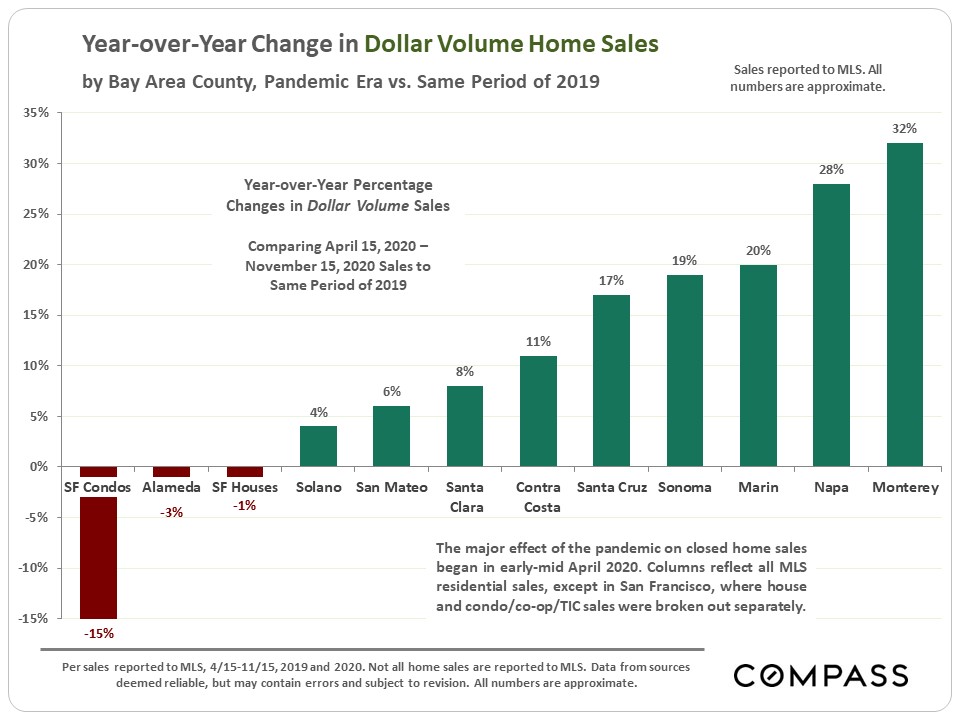

Marin County has seen one of the highest year-over-year increases in dollar volume sales, exceeded only by Napa and Monterey Counties. |

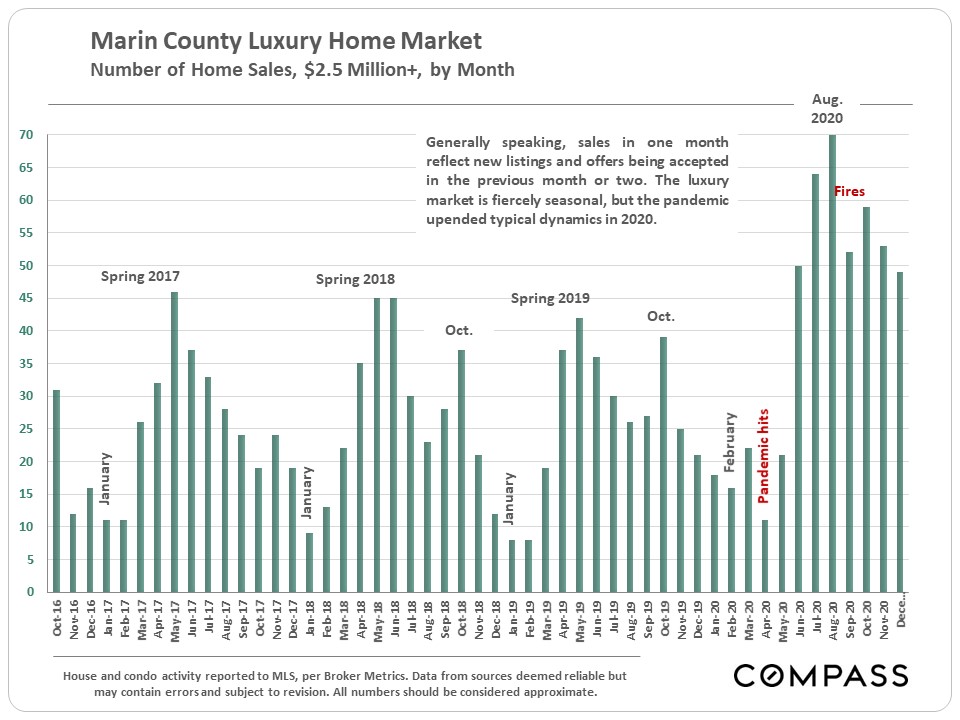

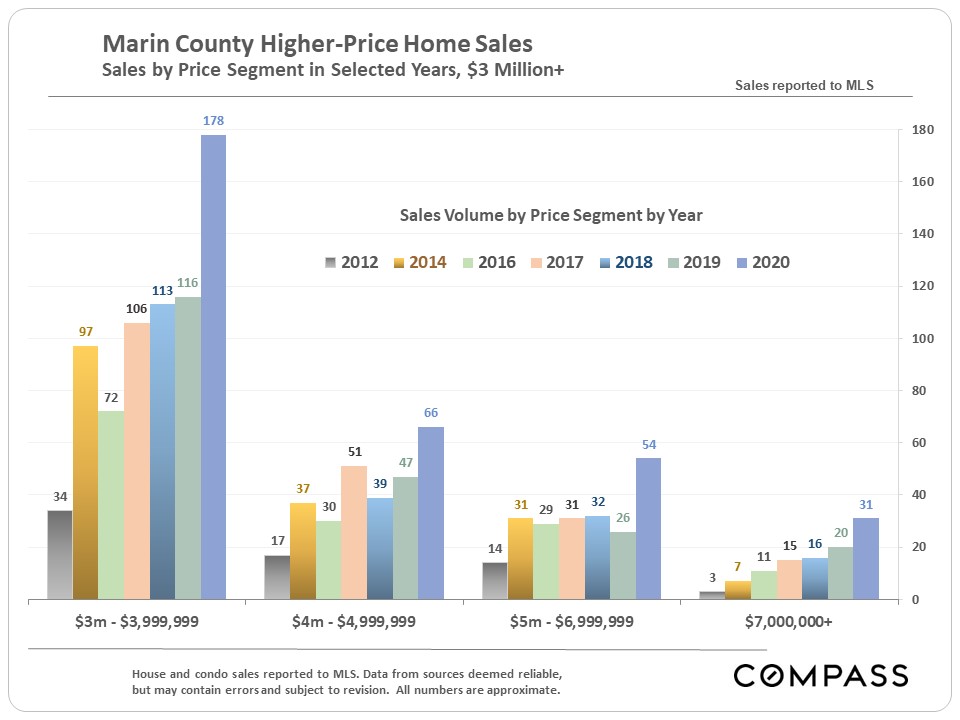

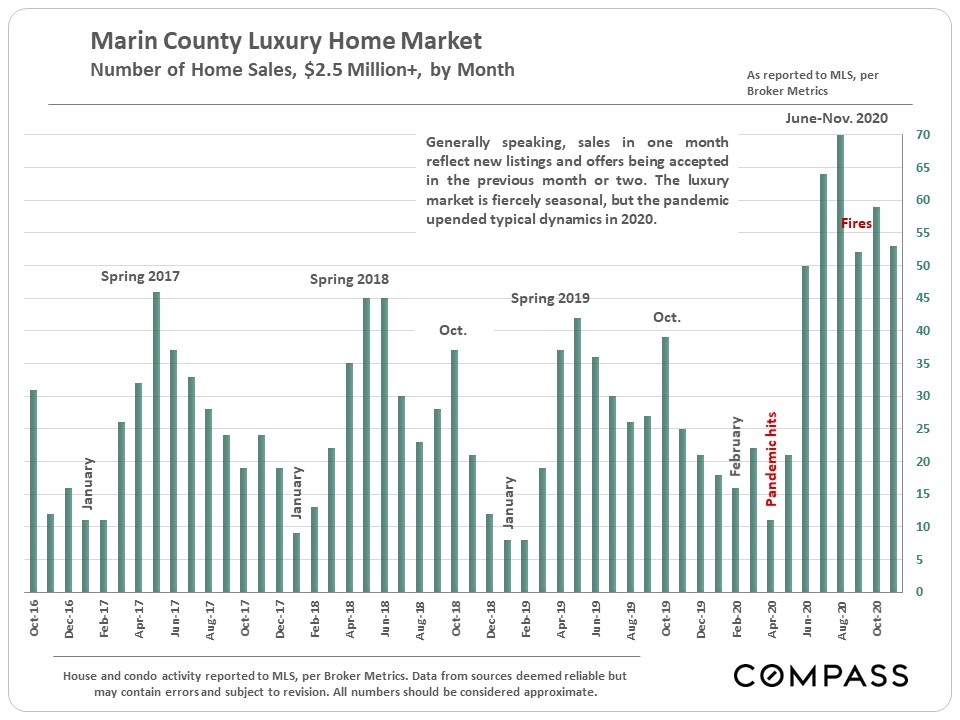

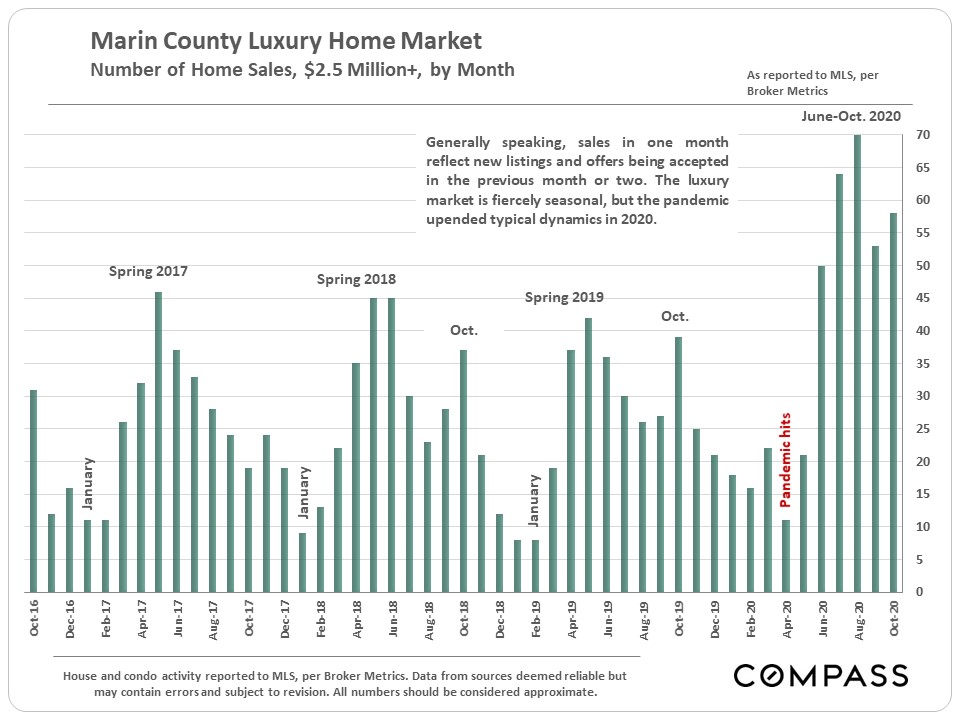

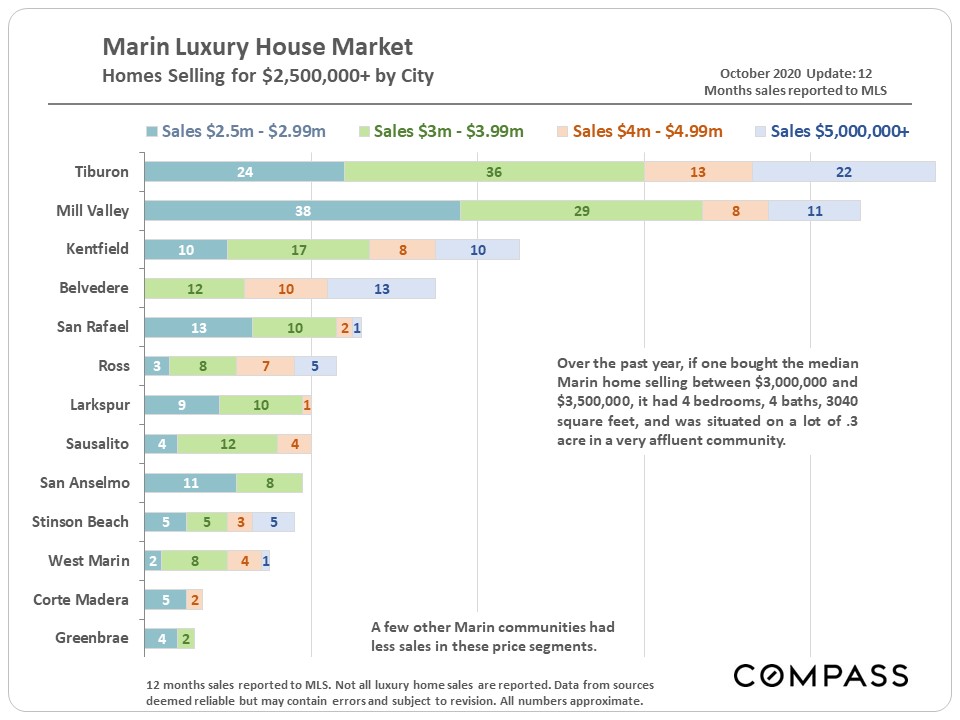

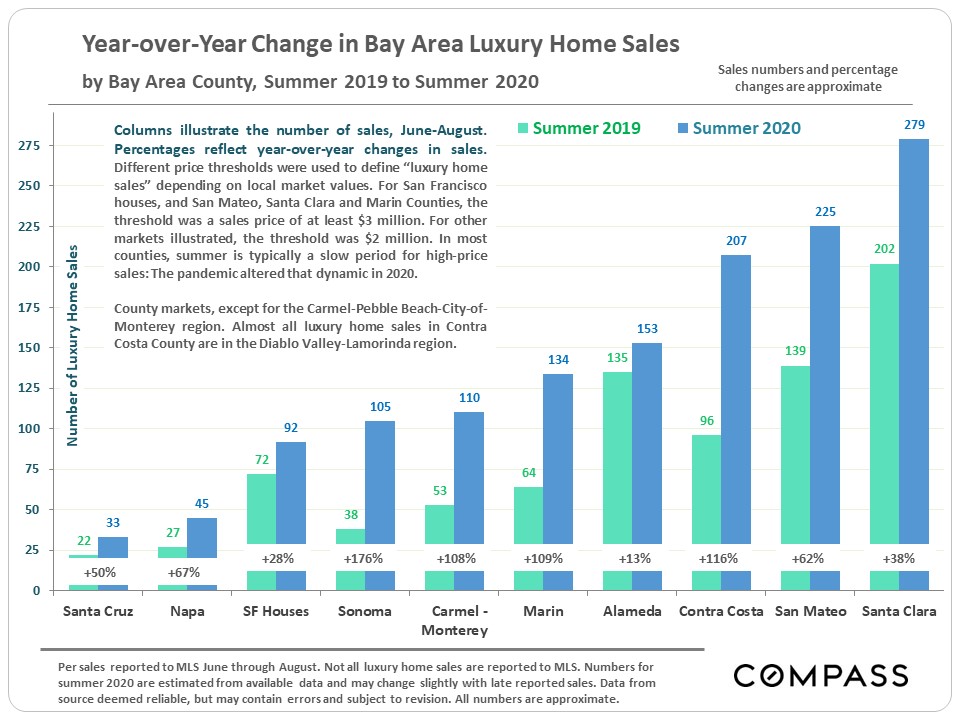

4 charts and tables on the Marin County and Bay Area luxury home markets. Most counties have seen an explosion of demand for big homes in exclusive locations. Sales volumes in several counties would certainly have been higher if not for the terrible fires. |

Annual median sales prices for houses of 5+ bedrooms, 3+ baths, 3500+ square feet in the more expensive communities of the 4 most expensive counties. |

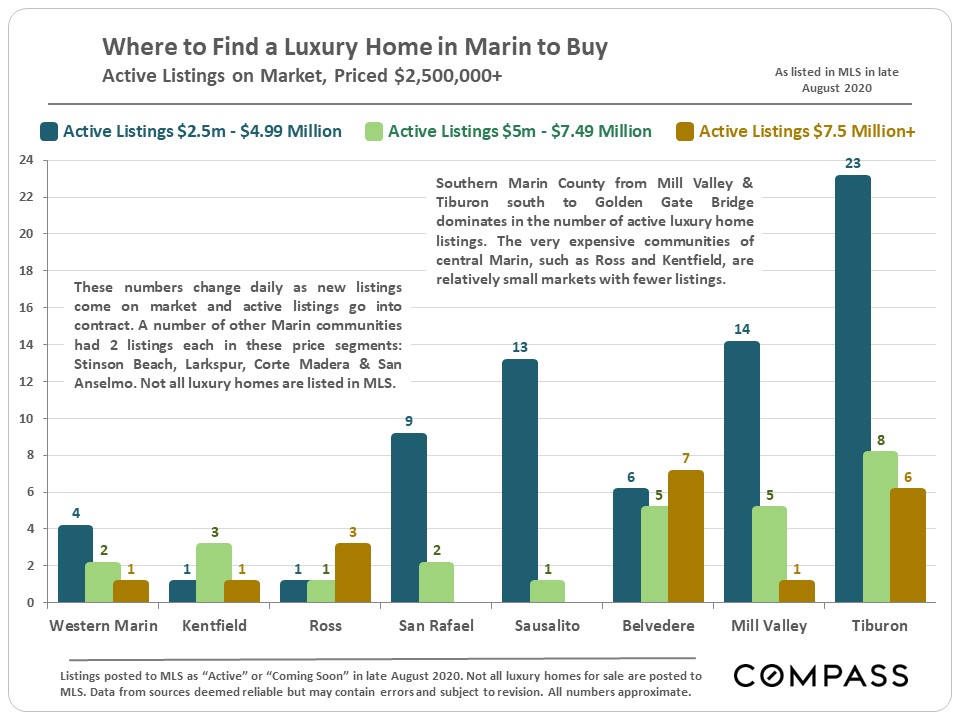

If you're looking for a home priced $5 million and above, these are the places where you will have the greatest choice of listings. In Marin, most of the highest priced markets are quite small as measured by the number of listings and sales. |

|

November 2020 Report Focusing Mostly on City Market Dynamics |

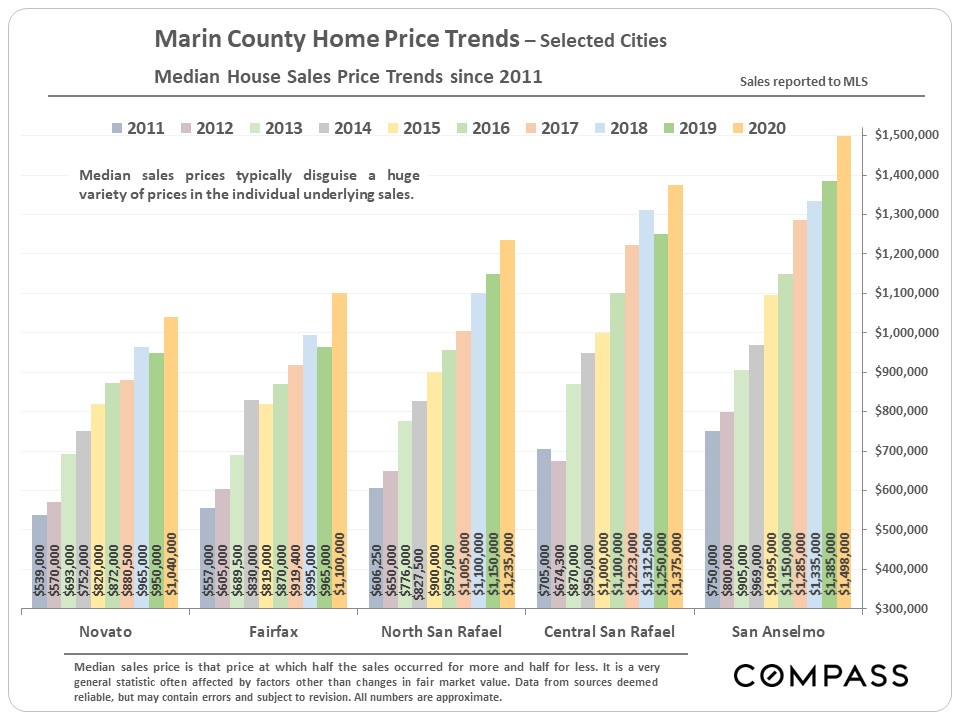

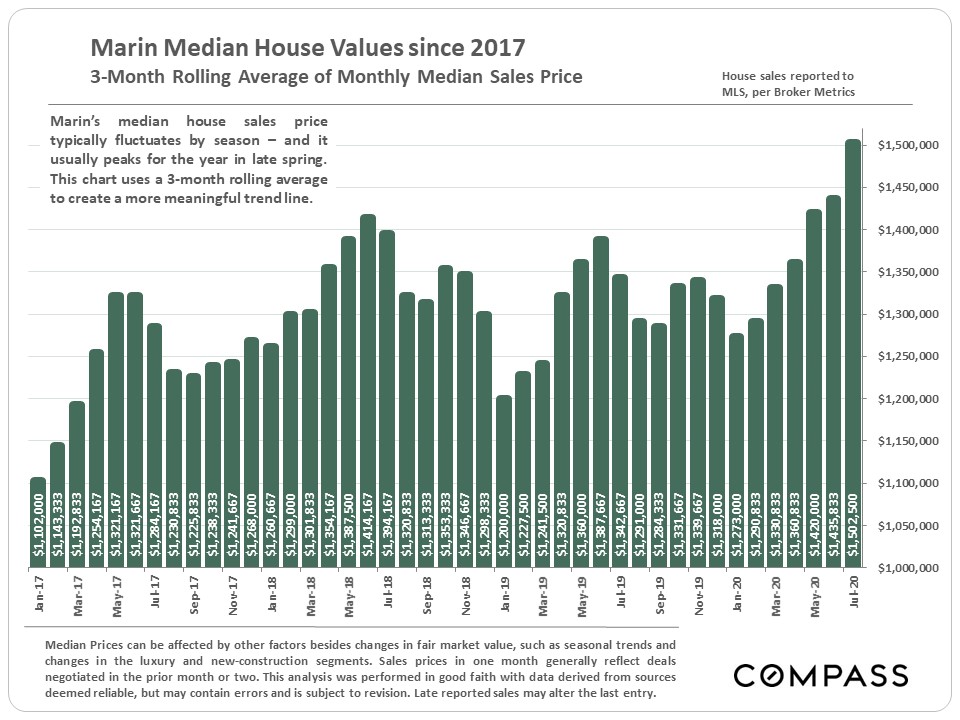

The long-term median sales price chart below is similar to those for counties around the Bay Area - a significant spike in median house prices since the pandemic struck in early spring. However, Marin has seen a more dramatic increase than most. As mentioned before, recent jumps in median house prices have been driven not only by appreciation in fair market values, but by large increases in expensive home sales. Affluent buyers have made up a significantly larger percentage of Marin and Bay Area home purchases since the pandemic hit. |

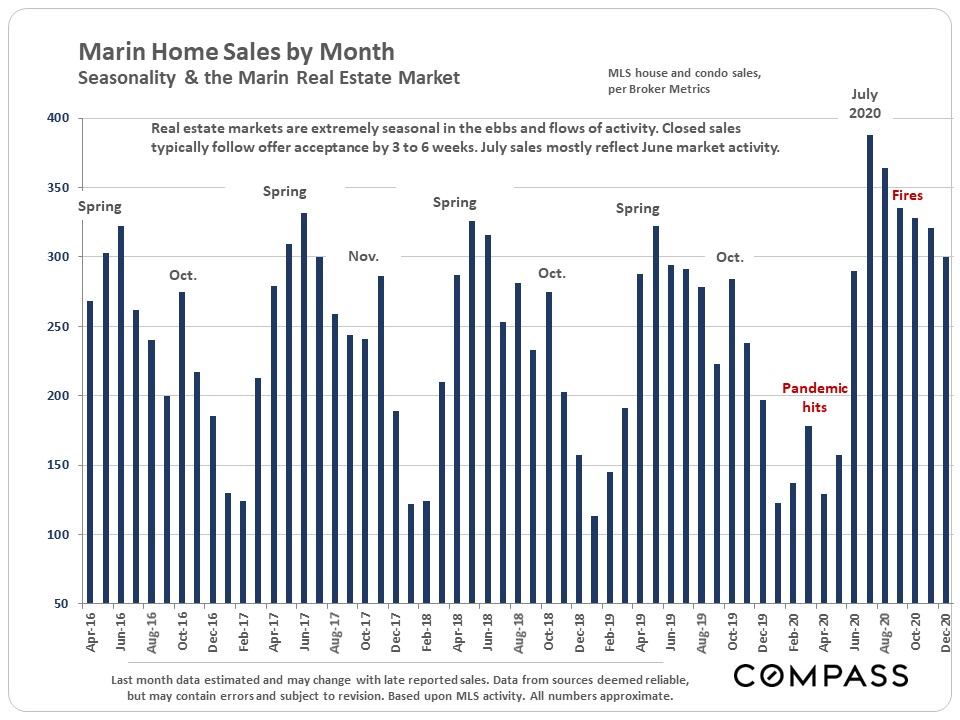

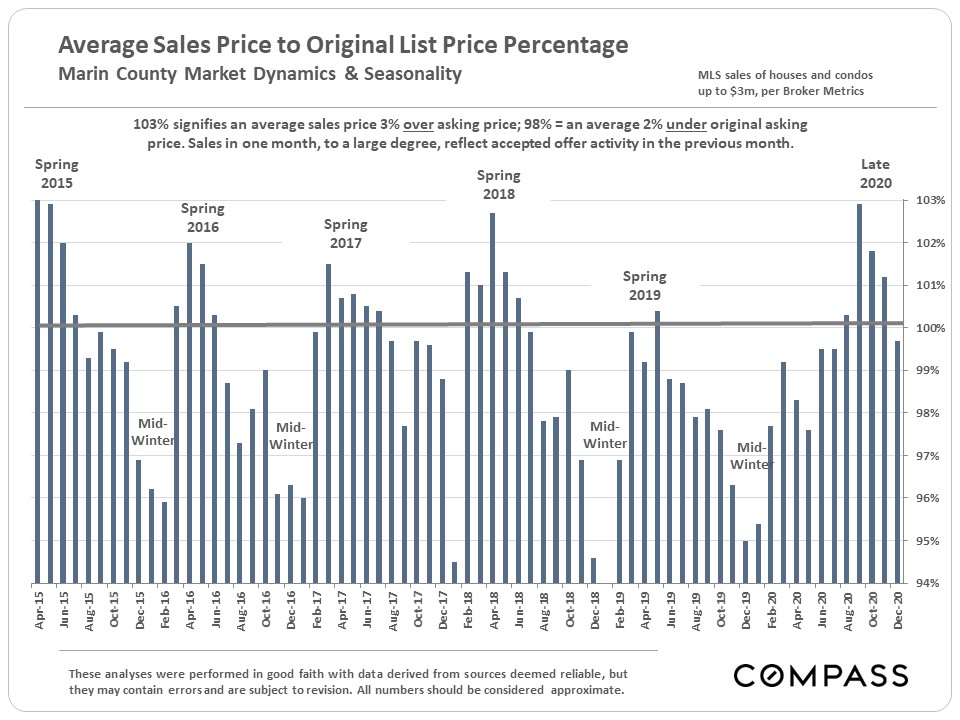

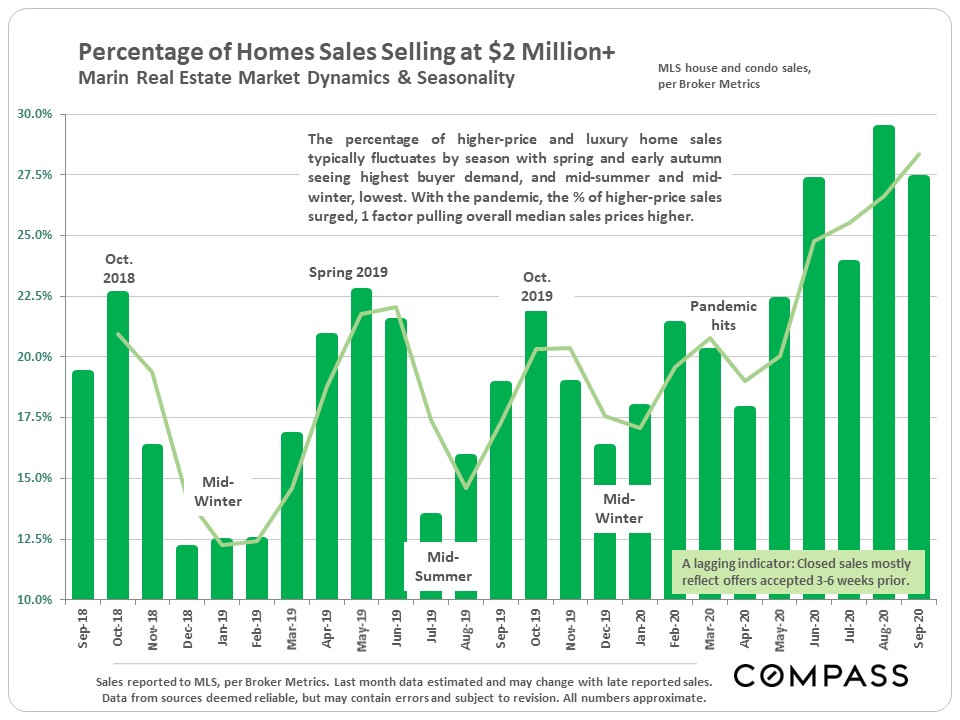

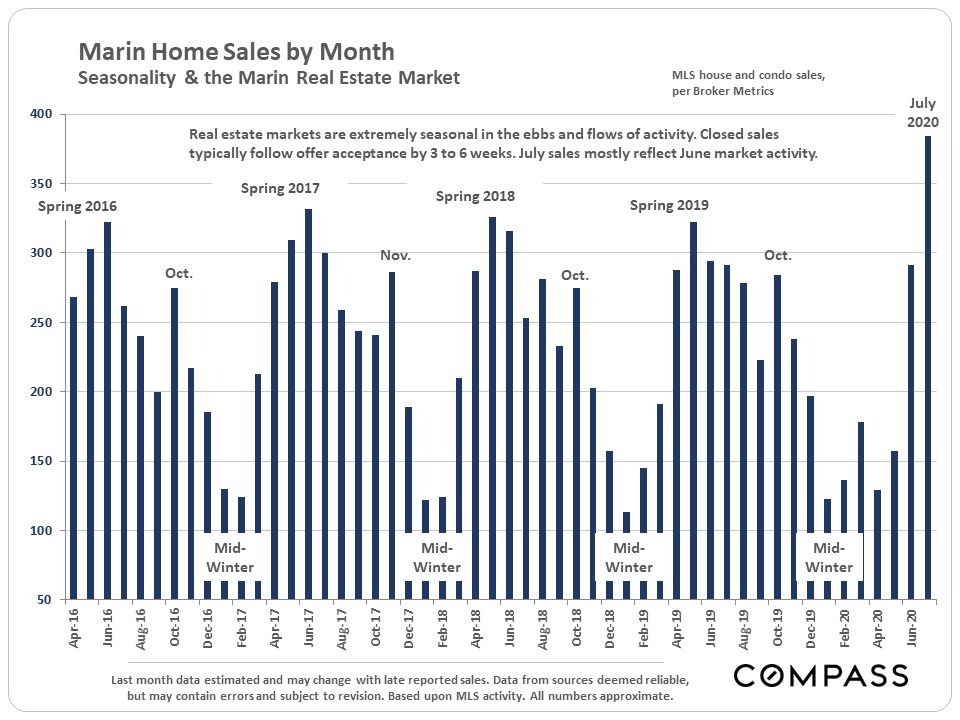

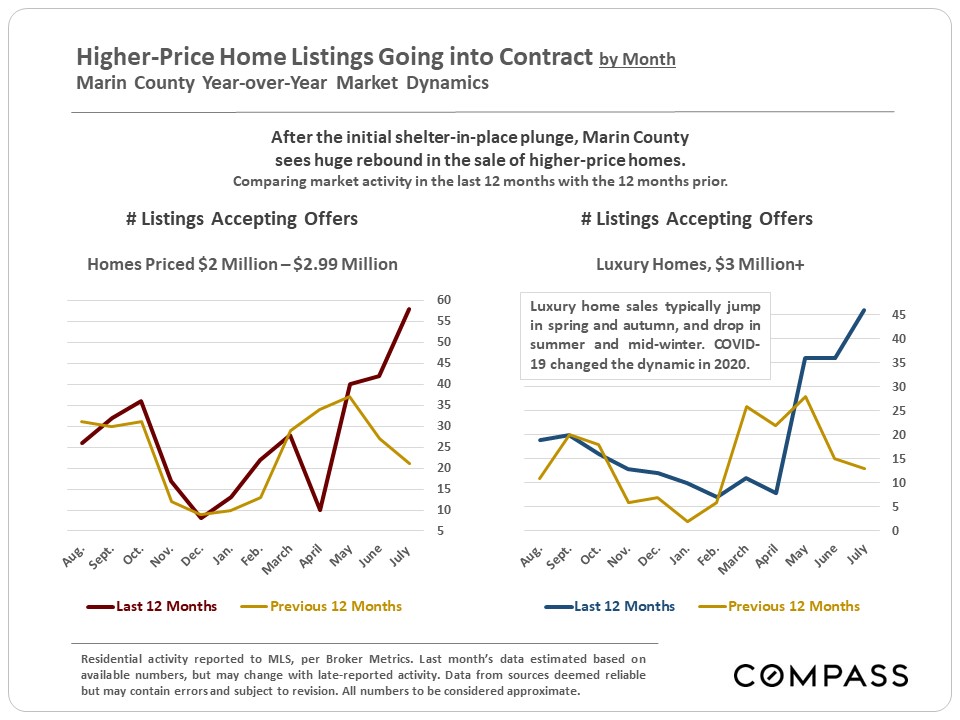

The market typically starts a big slowdown in mid-November, running through the mid-winter holidays, until it begins to wake up in mid-January: New listings and sales plummet, and listings pulled off the market soar. Higher-price segments normally see the most dramatic plunges in mid-winter activity. This year, the pandemic upended seasonality: Spring, usually the strongest selling season, saw a crash in activity; summer, which typically slows down - especially for luxury home sales - saw extremely high demand, particularly at the high end. However, some counties, including Marin, were impacted - usually only temporarily - by the terrible fires. We suspect late Q4 will see a slowdown, but, on current trends, remain more active than in past years. |

Higher-Price Home Sales by Month |

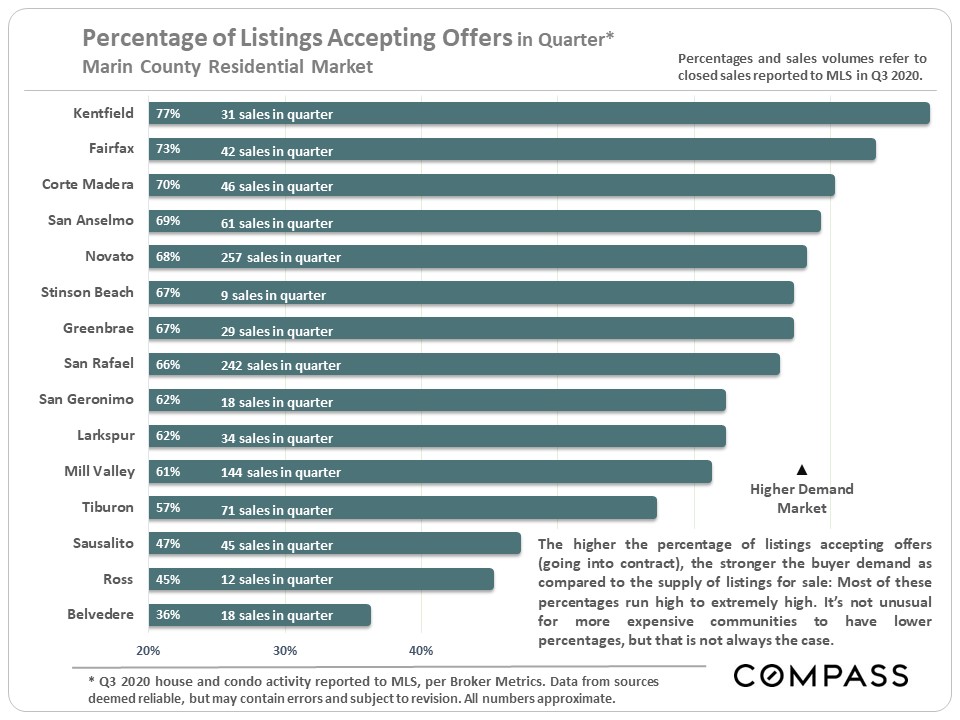

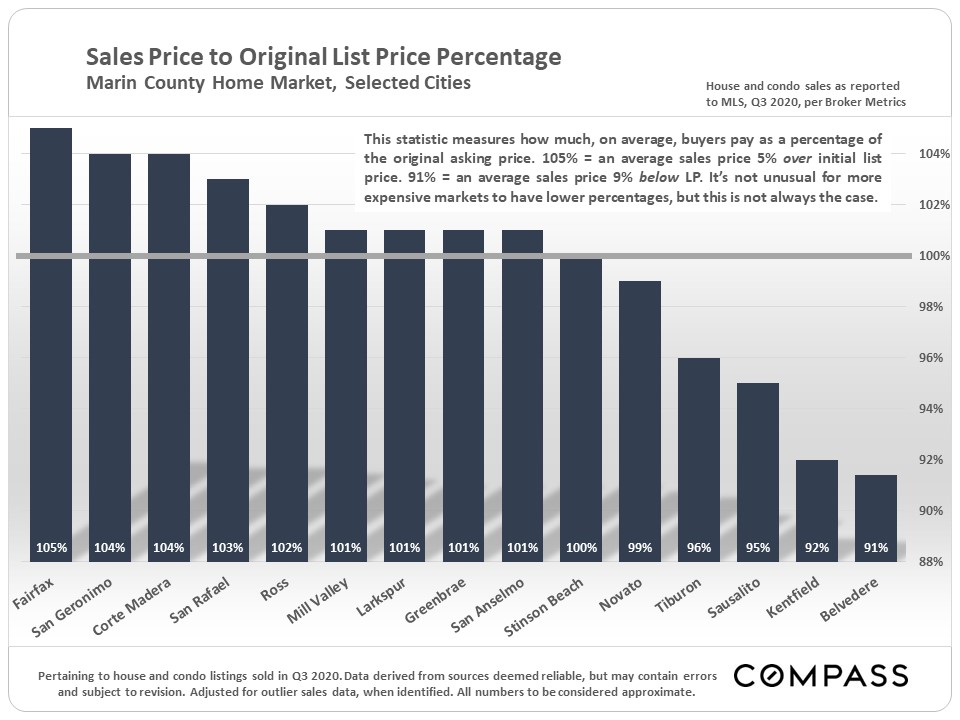

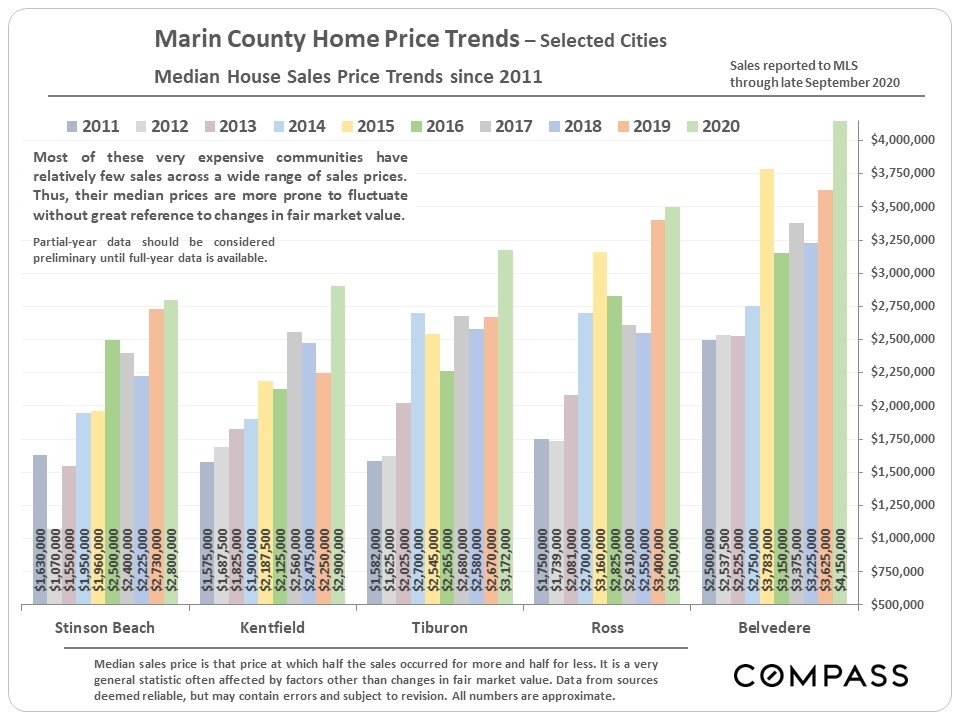

Following is a series of analyses that look at city median sales prices, luxury home sales, listings for sale, and a few standard measurements of supply and demand. Note that very expensive homes often see softer dynamics - the pool of buyers is much smaller, and overpricing more common for these very special properties - but this is not always the case. |

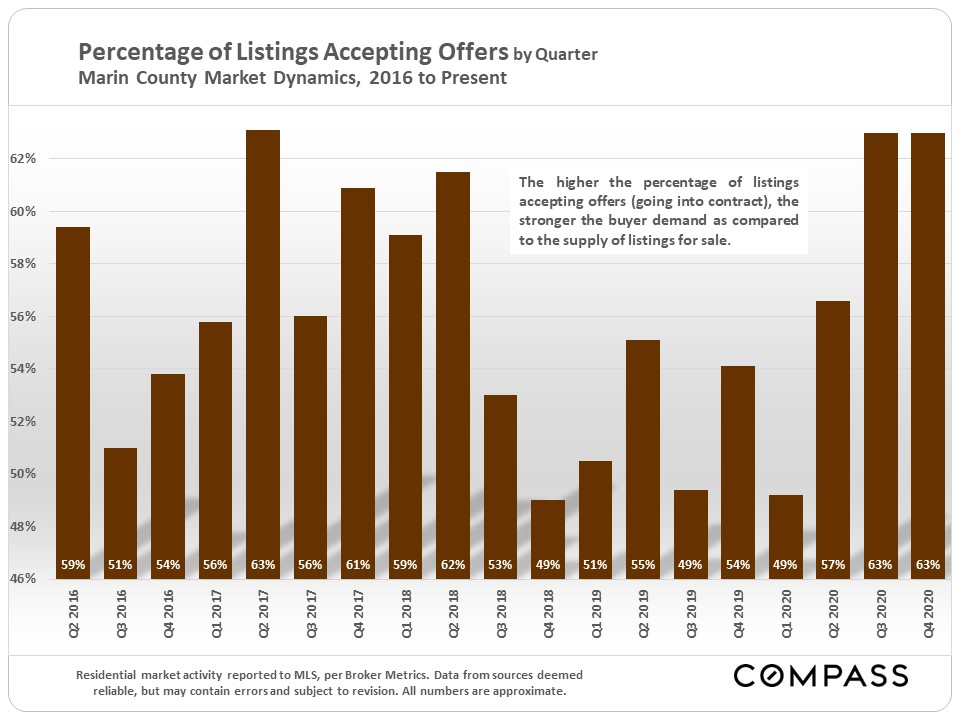

Regarding the next chart: Percentages of 50% or more would typically be considered to reflect a high-demand market. Over 60% signifies very high demand, or as it climbs, extremely high demand. As mentioned before, very high price markets often, but not always, see softer supply and demand indicators. |

|

7 Months into the Pandemic |

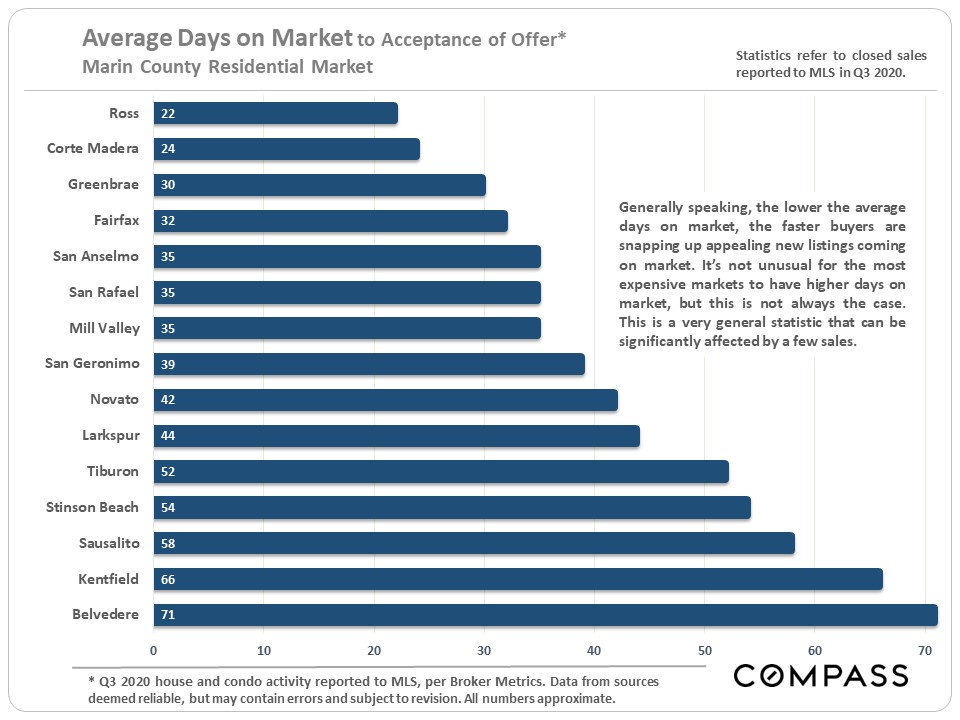

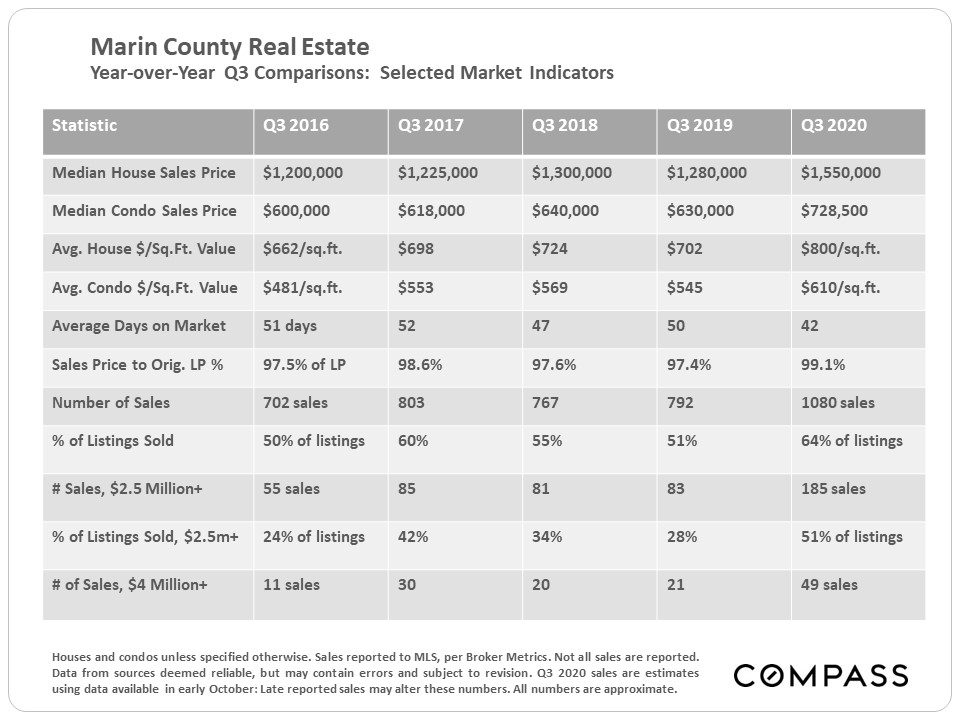

The table below compares Q3 statistics across 5 years. The huge jump in the median house sales price will be discussed further later in the report. |

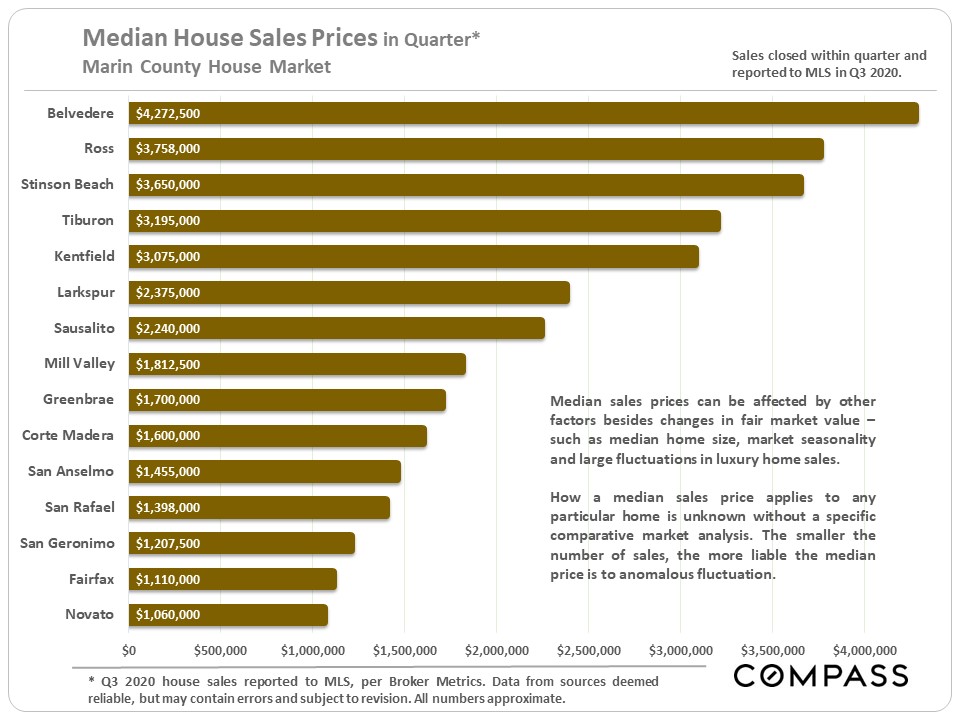

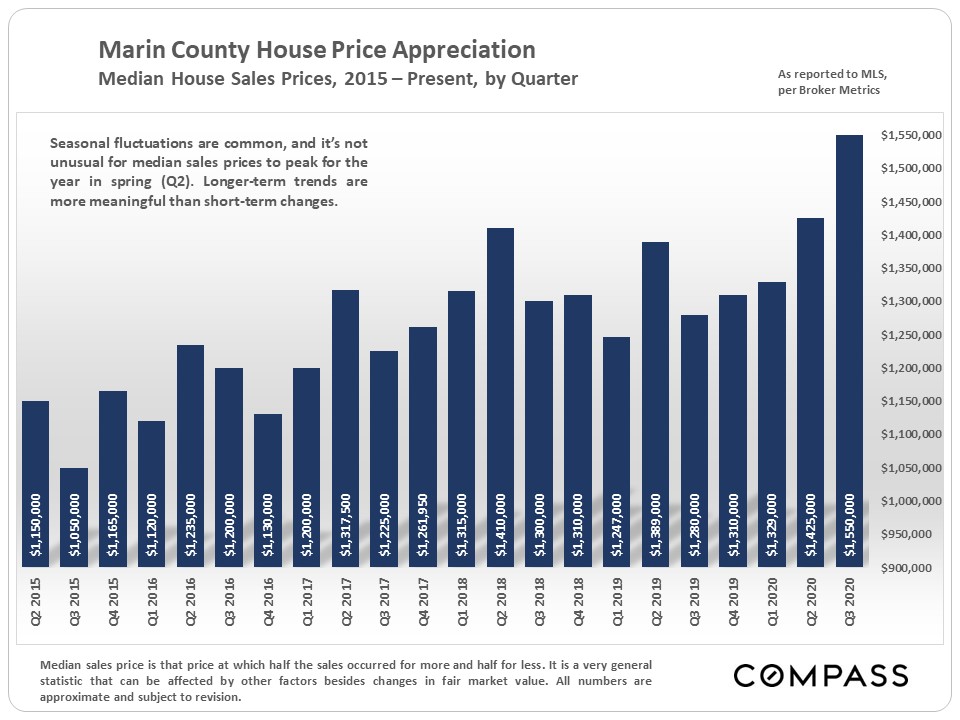

Median House Sales Price by Quarter |

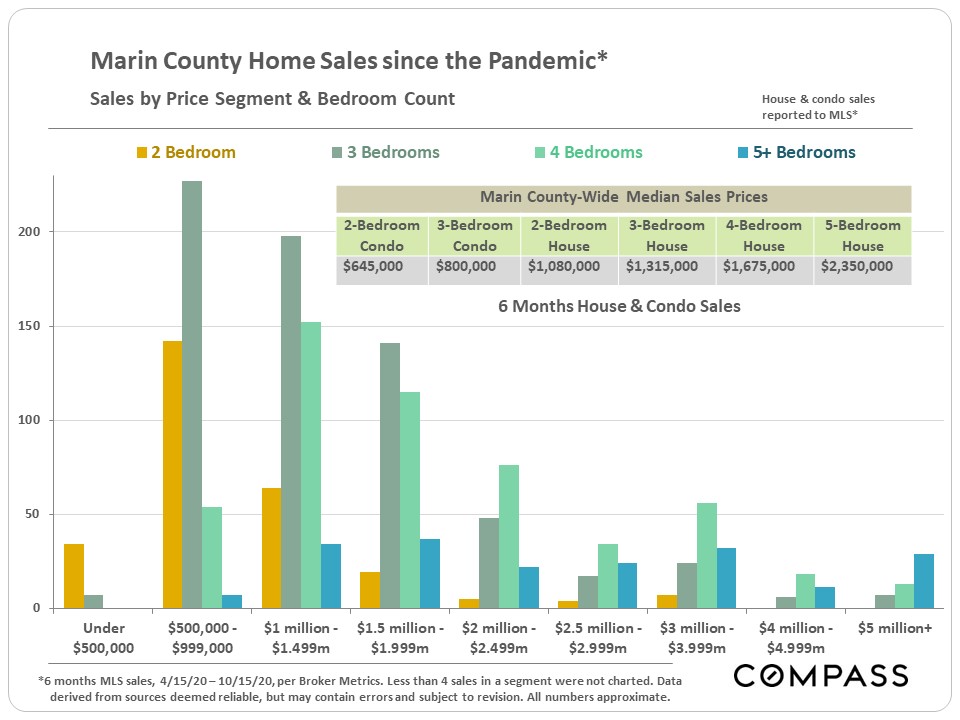

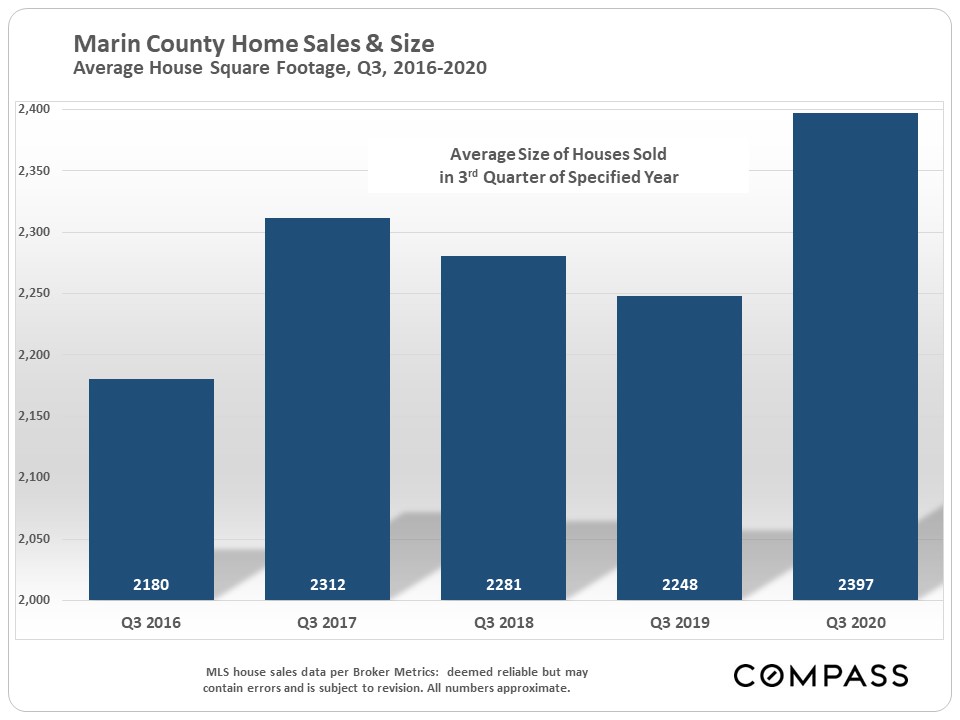

Median sales prices can rise because of increases in fair market value – i.e. buyers are paying more money for the same home (supply and demand) – and/or because buyers are purchasing larger, more expensive houses, often in more expensive communities. Both dynamics are currently at play, but it is certain that affluent and very affluent buyers have made up a dramatically increasing percentage of the demand in Marin and Bay Area markets. This next chart illustrates the large year-over-year increase in the average size of houses sold. |

And this chart graphs the increasing percentage of higher-price home sales in recent months. |

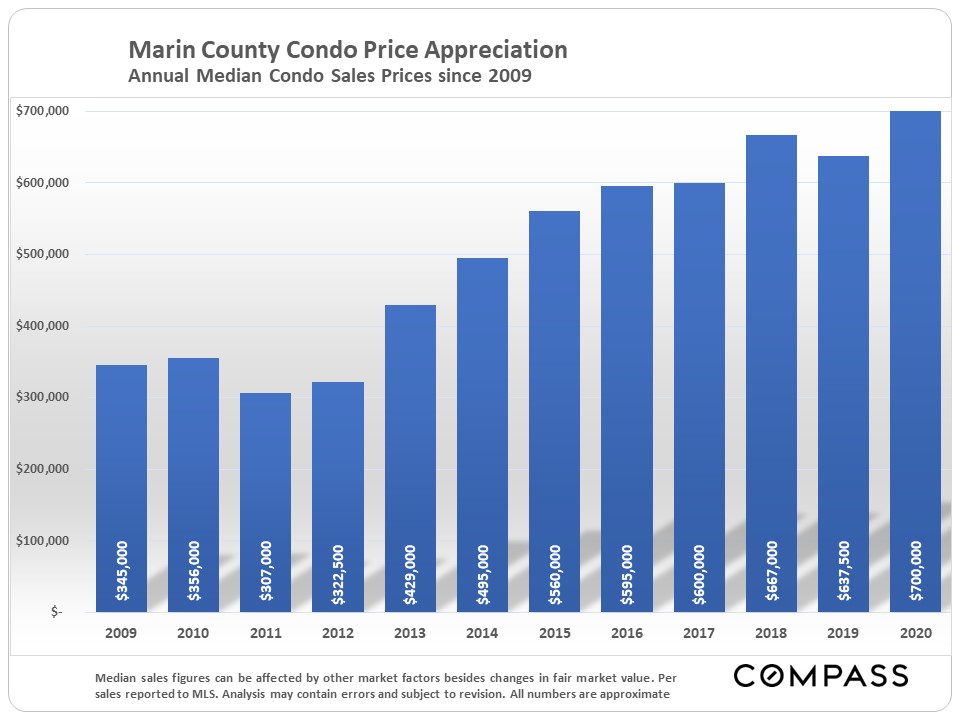

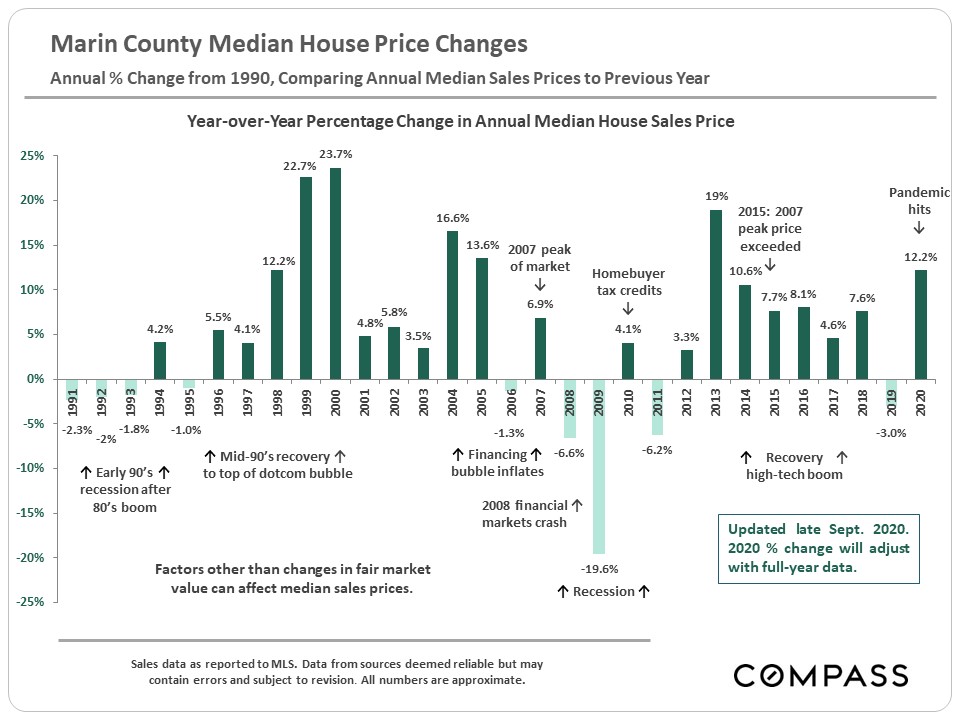

Annual percentage changes in median house sales price: The 2020 YTD percentage will almost certainly change, one way or another, by the time full-year sales data is in. |

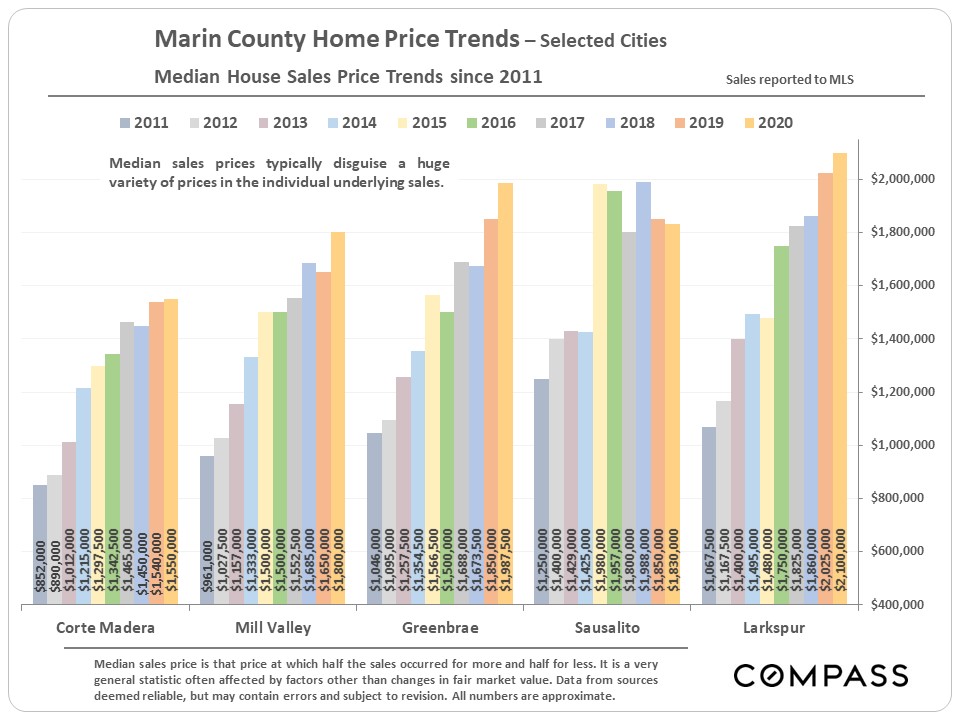

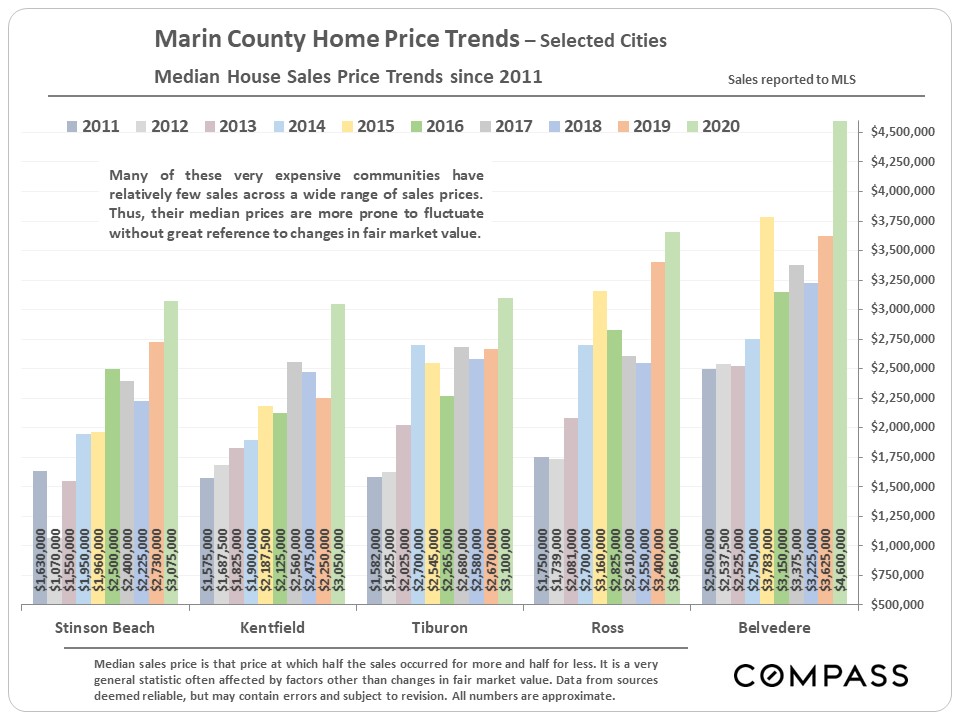

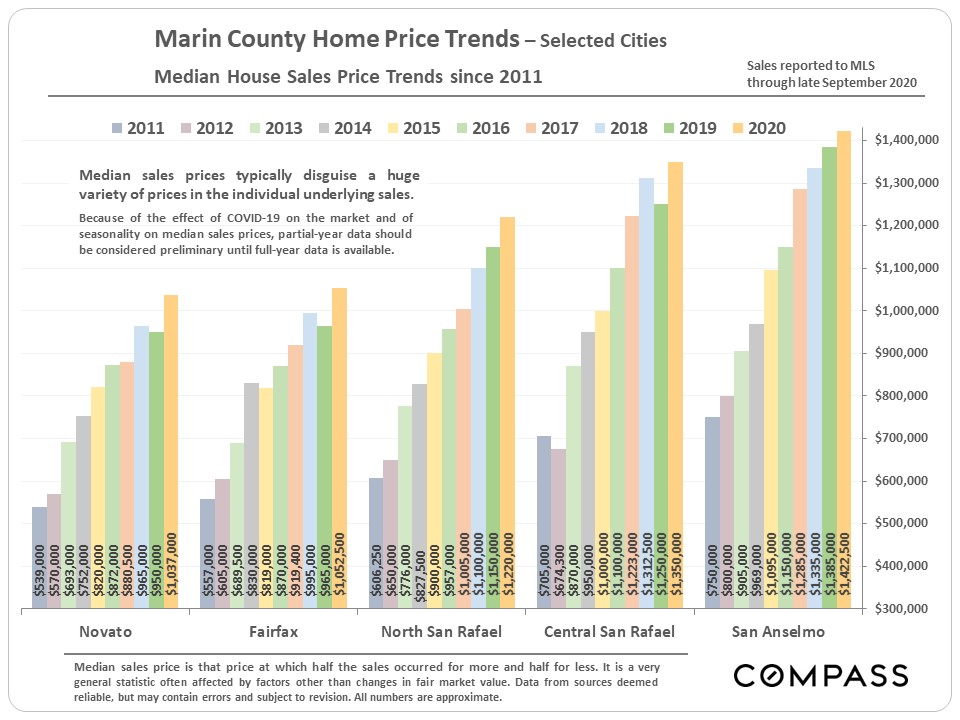

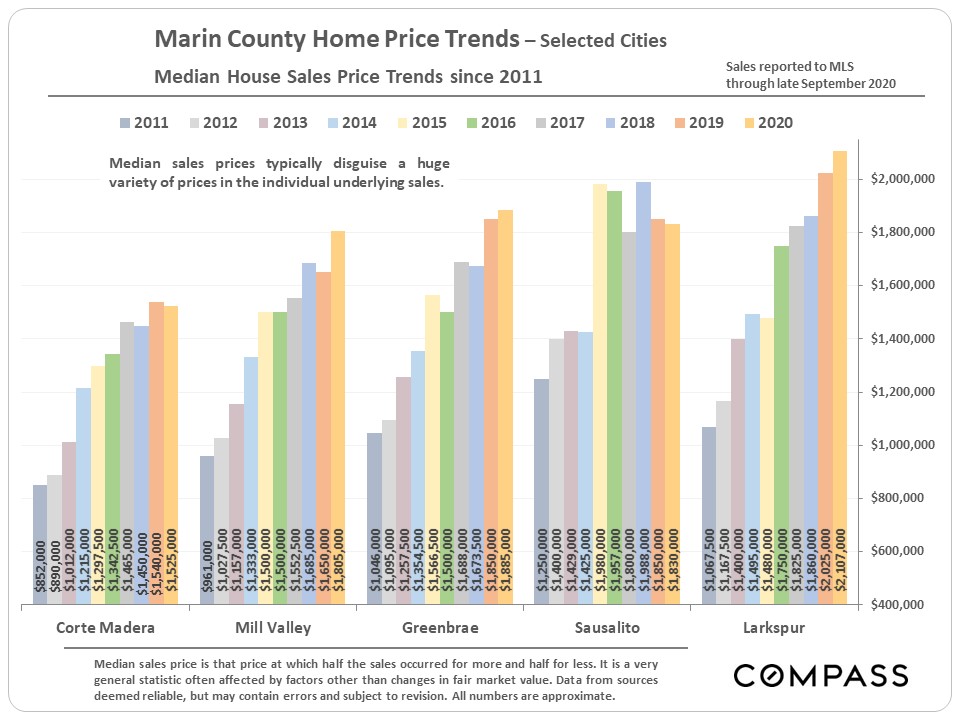

Median House Sales Price Trends by City |

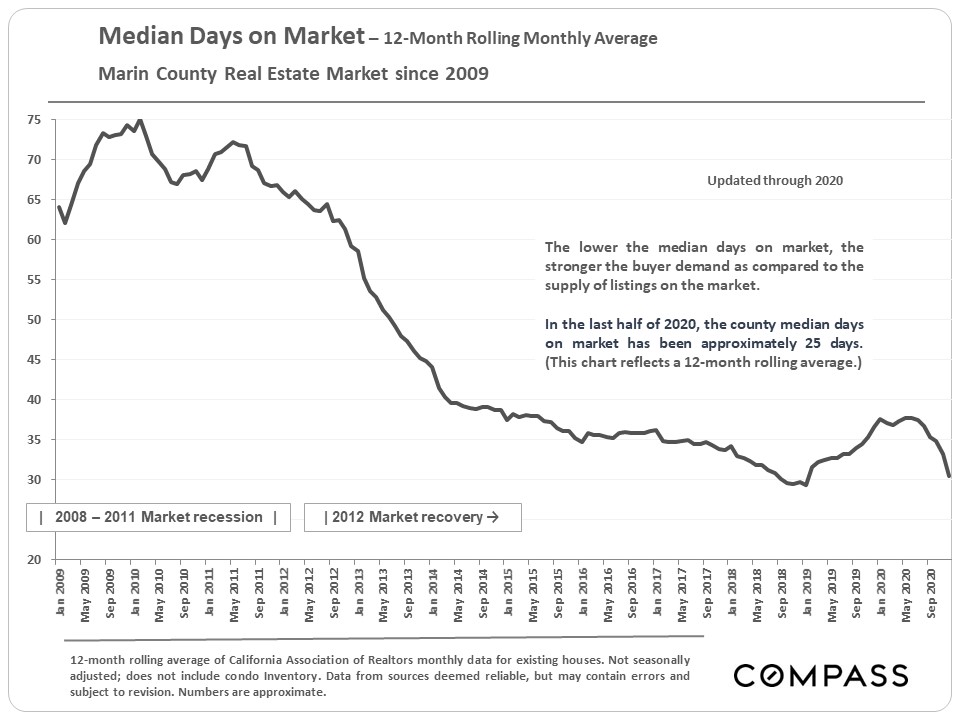

Selected Supply & Demand Indicators |

|

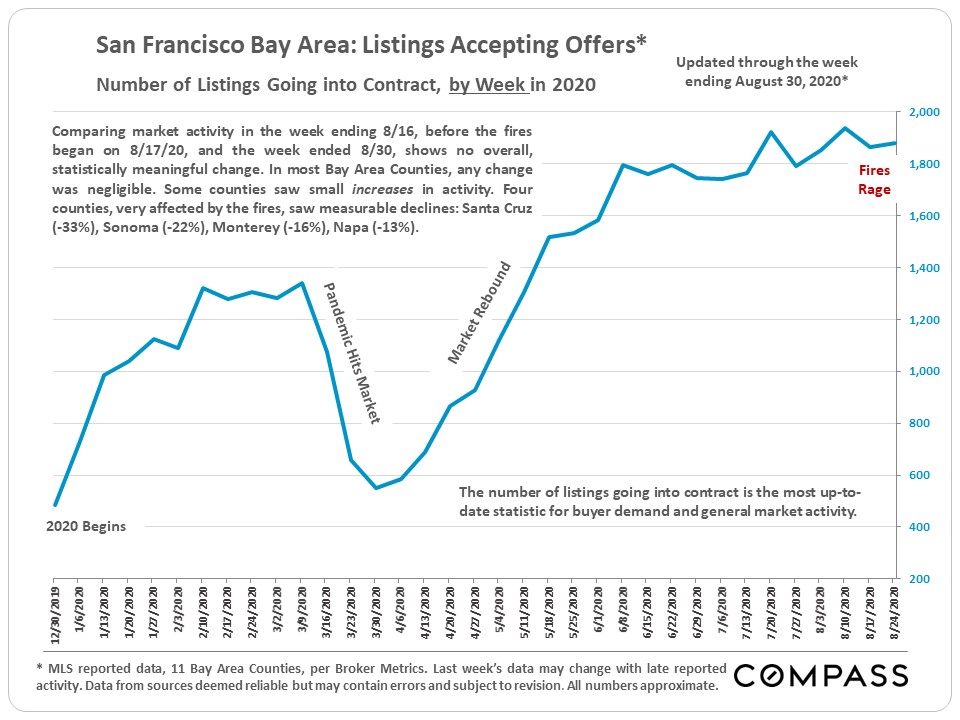

Very surprisingly, the terrible fires did not significantly impact the number of deals being made in most Bay Area counties during the last 2 weeks of August - the exceptions being Santa Cruz, Sonoma, Monterey and Napa Counties, which saw declines of 13% to 33%. Marin's numbers didn't really change at all in the second half of the month. (This chart looks at week by week activity in the Bay Area.) |

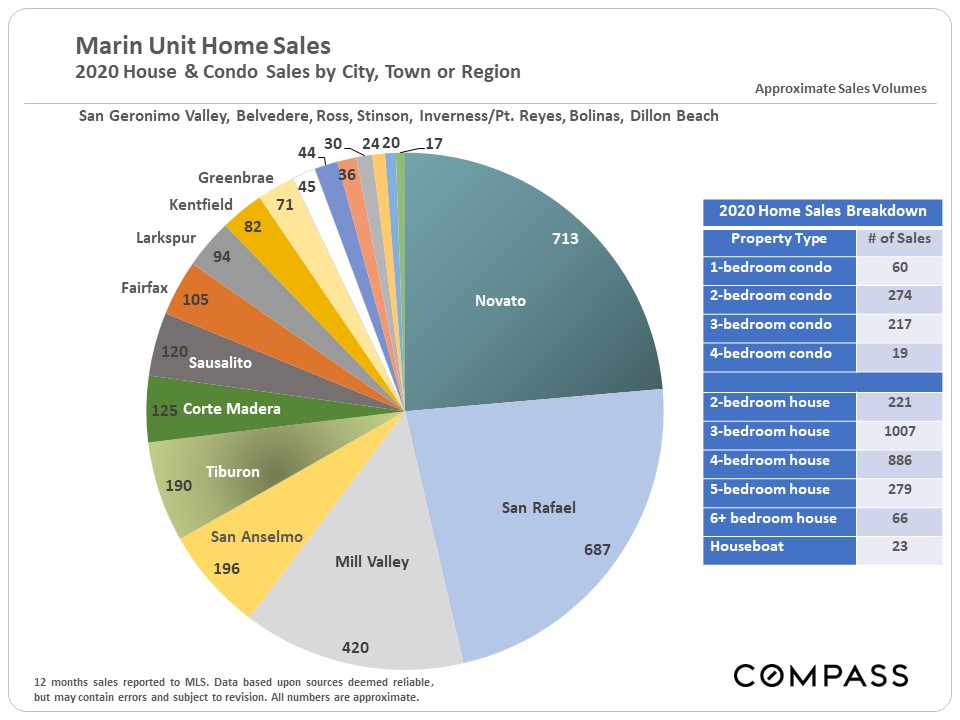

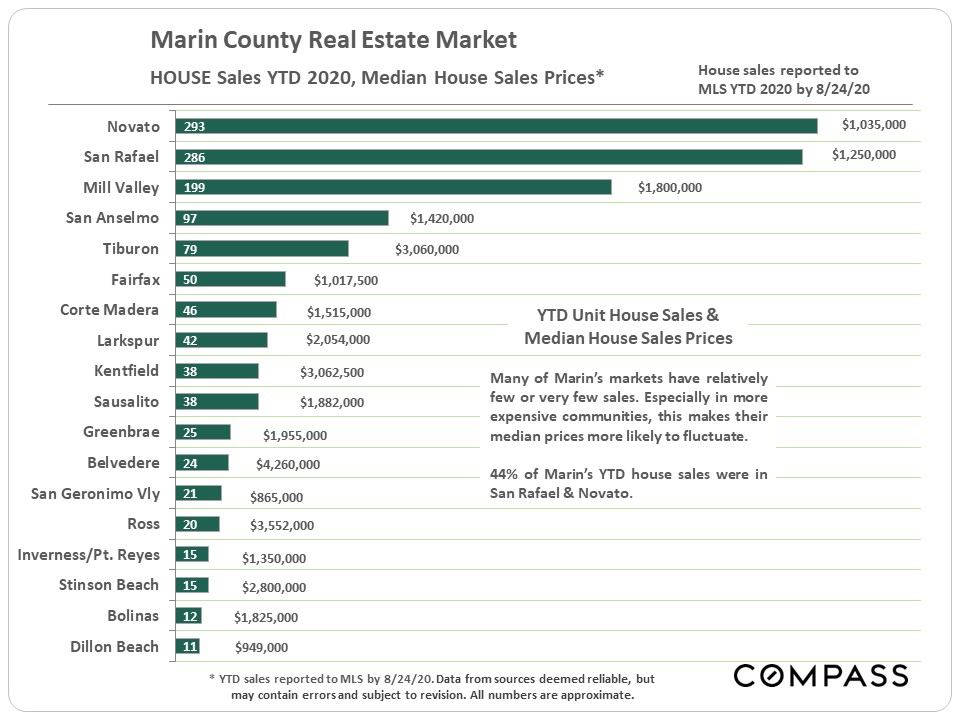

Year-to-date, house sales and median house sales prices by city: As can be seen, Novato and San Rafael dominate in terms of sales volume. |

2 charts - shorter-term and longer-term - regarding the Marin median house sales price. |

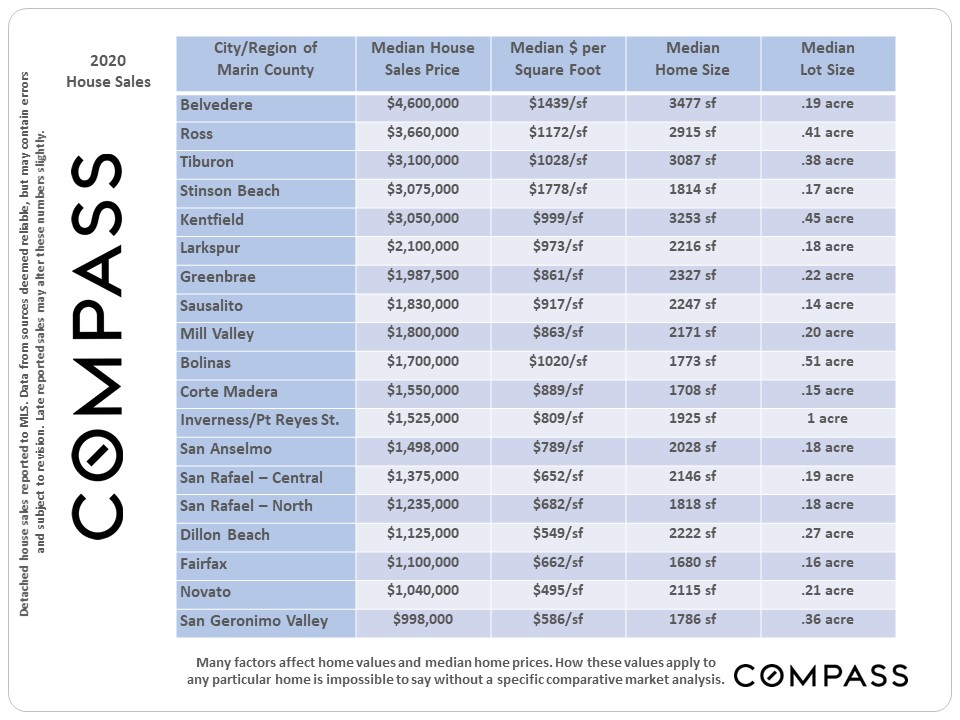

Bay Area median house sales prices, summer 2020. We've also broken out the more expensive county markets - generally located in central and southern Marin. |

Bay Area luxury home markets: Year-over-year, summer sales volumes and percentage changes. Marin County saw its luxury sales more than double over summer 2019. As compared to its population count, Marin has a very large and dynamic luxury home segment. |

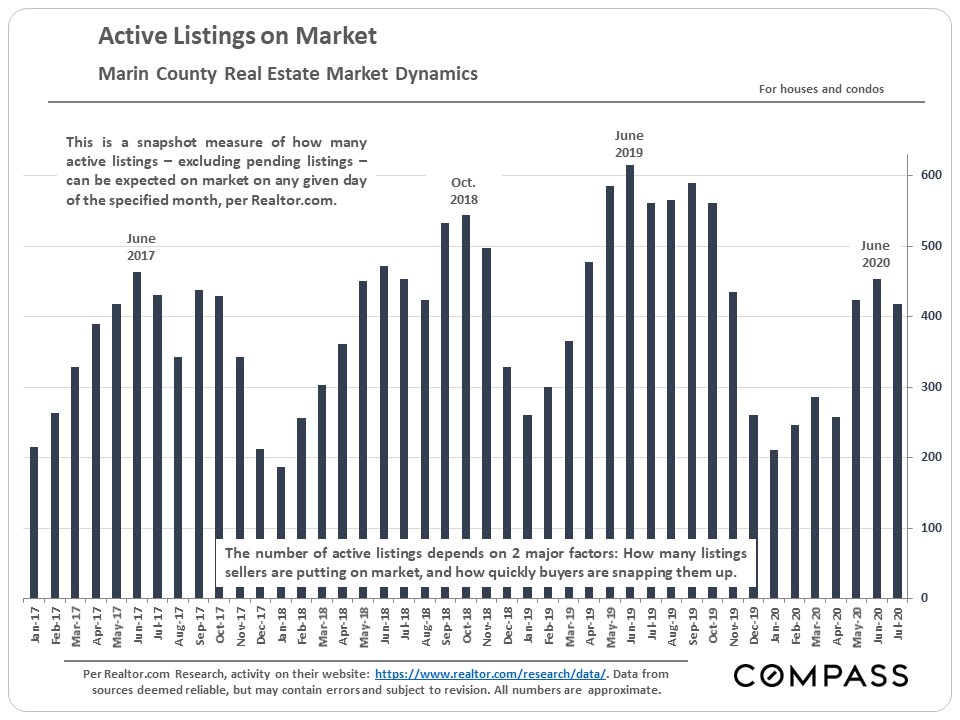

A snapshot measure of how many listings were typically active on any given day of the specified month: Marin's inventory of listings is running quite low, putting additional pressure on the market. |

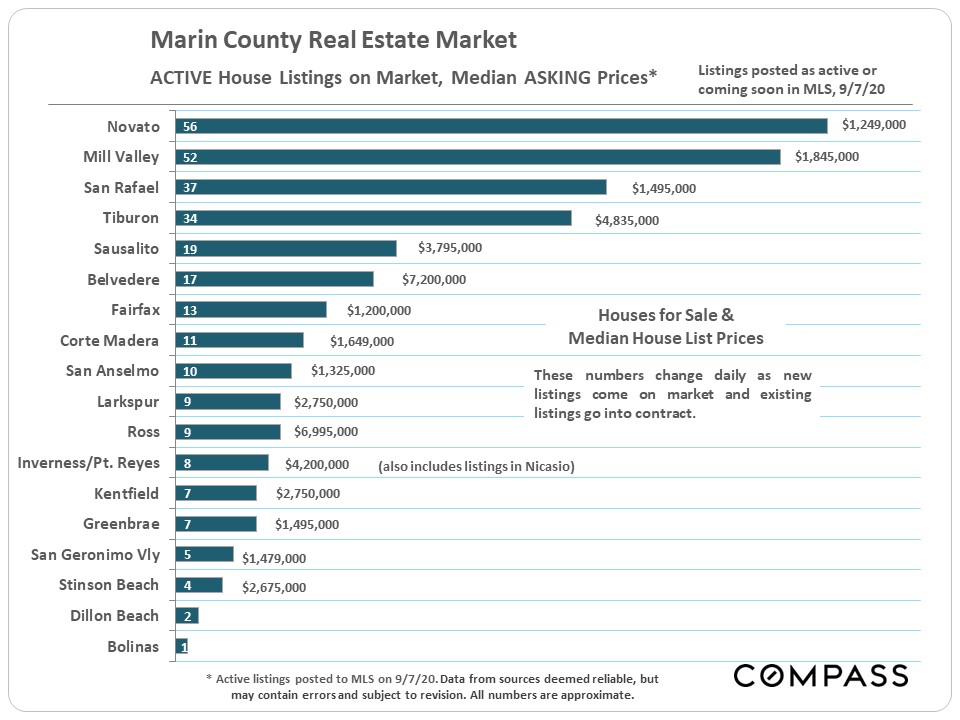

Active house listings and median house listing price by city as of September 7th. These numbers change daily, as new listings come on market and existing listings go into contract. |

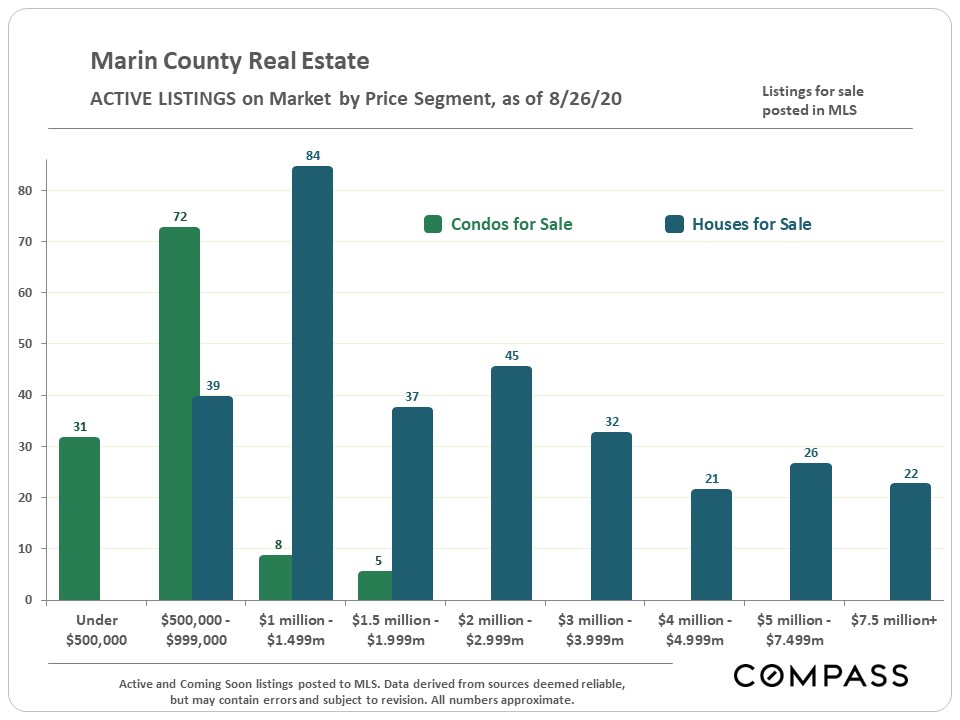

Active listings on the market in late August by price segment and property type. These numbers change daily. |

Active luxury home listing on market in late August by city. These numbers change daily. |

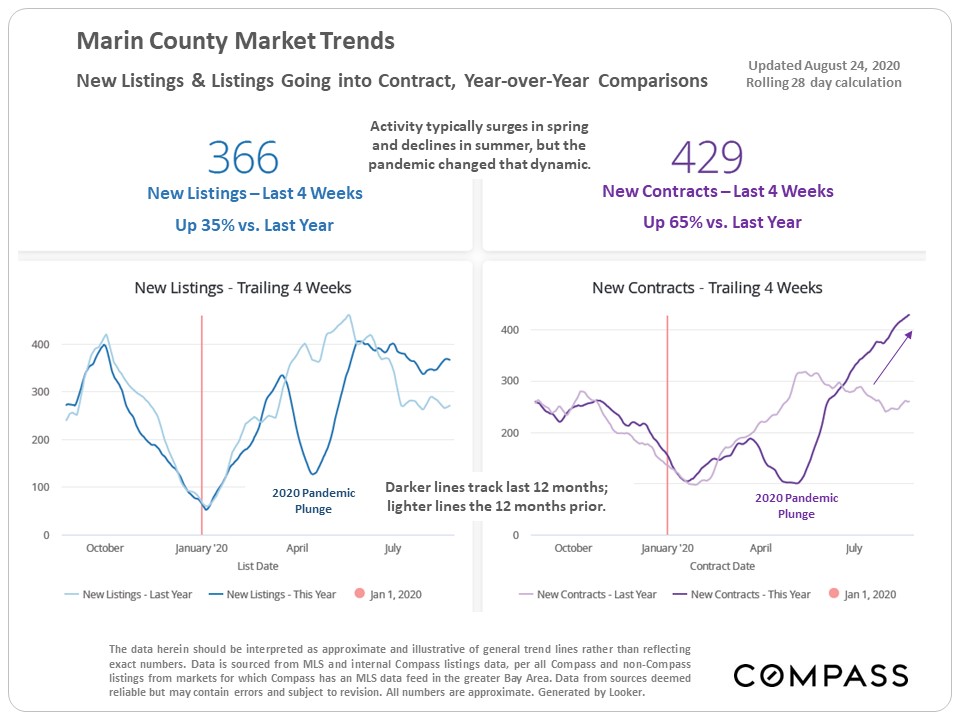

Year-over-year market indicators: New listings are up 35% vs. the number of listings going into contract up 65%. Buyers are snapping up listings faster than sellers are putting their homes on the market. |

The lower the Months Supply of Inventory (MSI),the stronger the demand as compared to the supply of listings. Most of the Marin market remains very deep in "seller's market" territory by this measure. |

|

Marin County Real Estate Report |

Median house sales price hits new high; year-over-year total listing inventory down; sales activity way up; luxury home sales soar |

Median House Sales Price Trend |

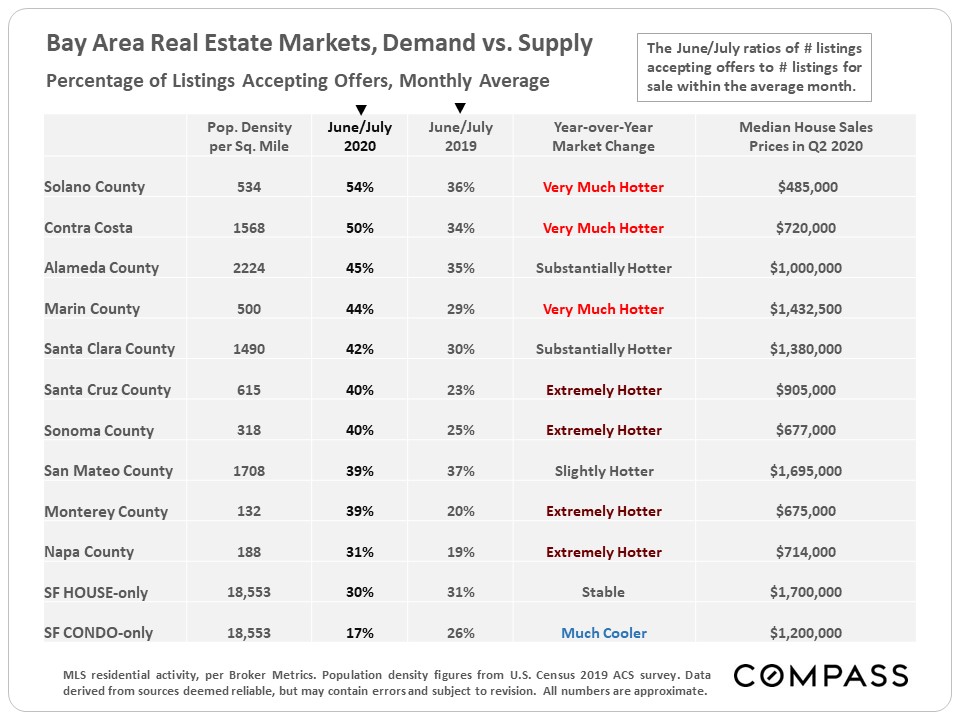

Bay Area Market Comparisons |

This table ranks each county by the percentage of active listings going into contract in June/July 2020 - a standard statistic of market heat - compares it to the same period of last year, and then rates the year-over-year change. Of the 3 most expensive counties, Marin ranks first in market heat and in year-over-year change. |

Supply & Demand Active listings, new listings coming on market, listings going into contract and sales volume trends |

Selected Market Indicators |

Higher-Price & Luxury Home Listings Accepting Offers |

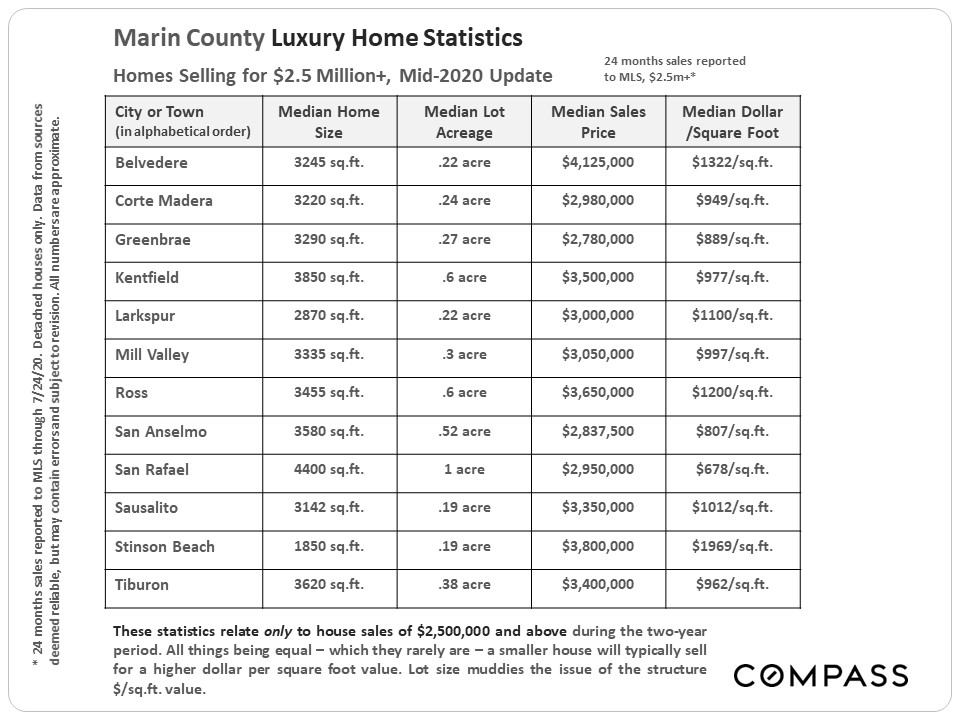

Selected Statistics on Homes Selling for $2.5 Million+ |

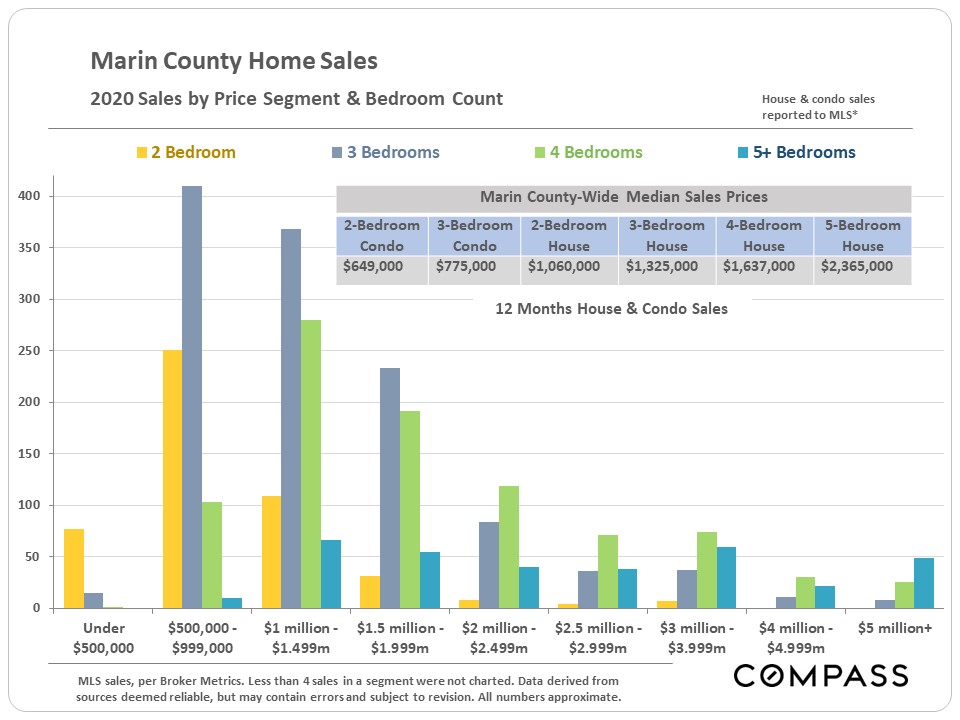

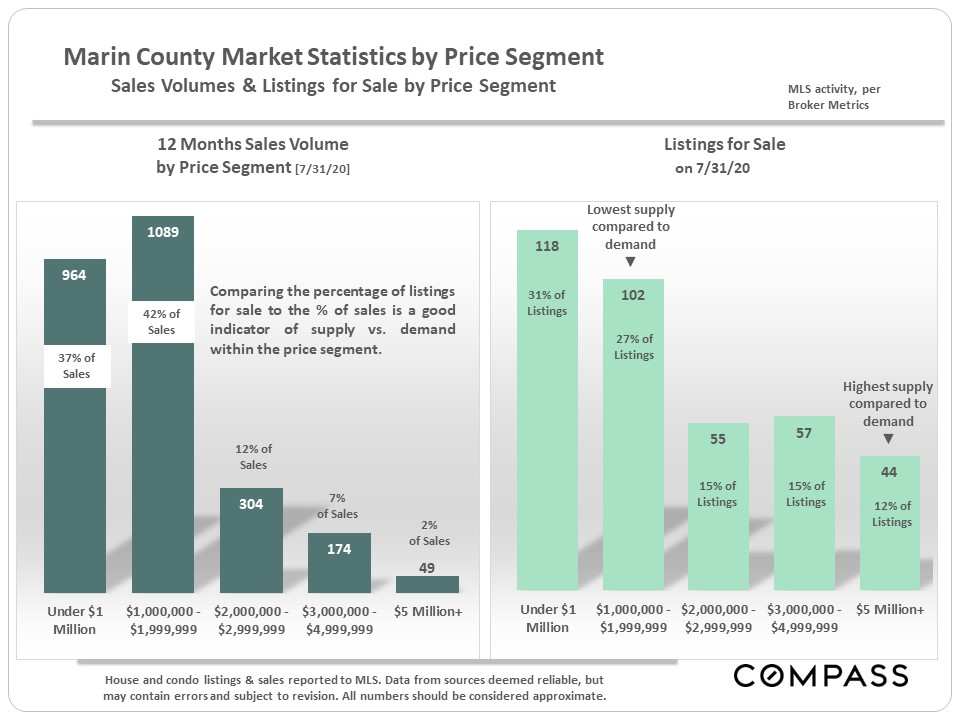

12 Months Sales & Listings for Sale, by Price Segment |

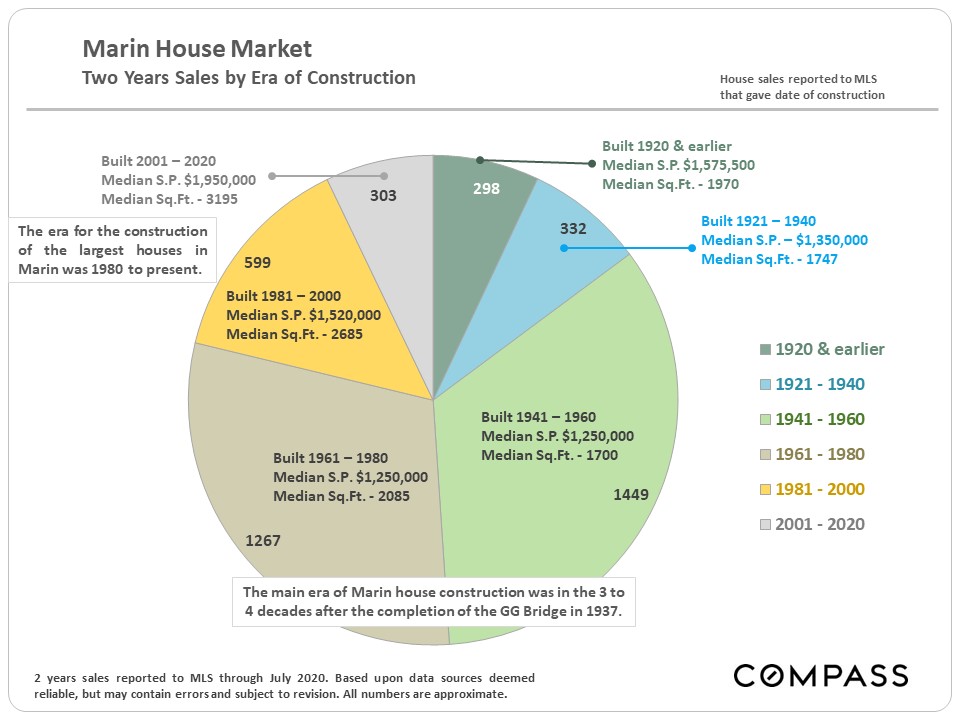

House Sales by Era of Construction |

© Compass 2020 ¦ All Rights Reserved by Compass ¦ Made in NYC Compass is a real estate broker licensed by the State of California operating under multiple entities. License Numbers 01991628, 1527235, 1527365, 1356742, 1443761, 1997075, 1935359, 1961027, 1842987, 1869607, 1866771, 1527205, 1079009, 1272467. All material presented herein is intended for informational purposes only and is compiled from sources deemed reliable but has not been verified. Changes in price, condition, sale or withdrawal may be made without notice. No statement is made as to accuracy of any description. All measurements and square footage are approximate. Equal Housing Opportunity. |

|

|

It is impossible to know how median and average value statistics apply to any particular home without a specific comparative market analysis. These analyses were made in good faith with data from sources deemed reliable, but may contain errors and are subject to revision. It is not our intent to convince you of a particular position, but to attempt to provide straightforward data and analysis, so you can make your own informed decisions. Median and average statistics are enormous generalities: There are hundreds of different markets in San Francisco and the Bay Area, each with its own unique dynamics. Median prices and average dollar per square foot values can be and often are affected by other factors besides changes in fair market value. Longer term trends are much more meaningful than short-term. Compass is a real estate broker licensed by the State of California, DRE 01527235. Equal Housing Opportunity. This report has been prepared solely for information purposes. The information herein is based on or derived from information generally available to the public and/or from sources believed to be reliable. No representation or warranty can be given with respect to the accuracy or completeness of the information. Compass disclaims any and all liability relating to this report, including without limitation any express or implied representations or warranties for statements contained in, and omissions from, the report. Nothing contained herein is intended to be or should be read as any regulatory, legal, tax, accounting or other advice and Compass does not provide such advice. All opinions are subject to change without notice. Compass makes no representation regarding the accuracy of any statements regarding any references to the laws, statutes or regulations of any state are those of the author(s). Past performance is no guarantee of future results.

More Information: Click Here